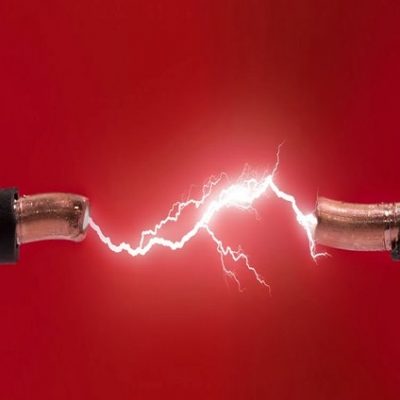

Whatever industry you’re operating in – whether it’s construction, marketing, retail, education or something else altogether – your employees face a number of hazards. For instance, your employees might face harm from heavy machinery, noisy equipment, chemicals and electricity, or even just standard trips and falls. And that’s where you come in. It’s your responsibility as an employer to ensure that you’re able to identify, manage and minimise the risks your employees face in a busy working environment. There are a number of rules and regulations on the matter, and penalties for non-compliance are severe… and that’s not to mention the cost of lost business, lost man-hours and a damaged reputation with clients and customers alike. So, here’s a very brief overview of how to minimise risks in your busy working environment. However, be sure to investigate your responsibility further using information from charities such as ROSPA (The Royal Society of the Prevention of Accidents), or guidance from the Health and Safety Executive. First, identify the hazards your employees face This is the starting point for reducing risks. Think about the environment, the processes and materials that have the potential to harm your employees, noting them down. Always ask for a second opinion, getting additional people involved – extra eyes are always a good idea. Then, refer back to your accident and sickness records: can you spot any hazards that are causing employees harm? It’s also a good idea to check guidance from the manufacturers of the equipment and substances you’re using, as they’ll often explain the hazards your employees are likely to be exposed to. Then, evaluate the risks and decide how you’re going to take action Next, you’ll need to decide how likely it is that harm will occur, and put some measures in place for reducing that chance. Don’t expect to eliminate risk completely, but do focus on the things you could do to reduce the likelihood of harm. For instance, can you change a process to circumvent dangerous practices? Can you issue protective clothing, install safety equipment or devise training programmes to better protect your employees? Be sure to record your findings, and report incidents and near misses whenever they arise There’s a lot you can learn when things go wrong, and taking a proactive attitude to it will hopefully mean that the level of risk your employees are exposed to will lessen over time. Finally, ensure you have adequate resources and software to manage risk One of the biggest obstacles for businesses managing risks in the workplace is that they simply don’t have the resources required to ensure everyone is as safe as they can be. So, consider investing risk management software available from providers such as Airsweb. Good quality software will equip you with tools such as best practice templates for employees to refer to, a centralised risk register, and the ability to check that the right employees have read risk assessments – ultimately, it gives you a centralised place to refer to and report back in to.