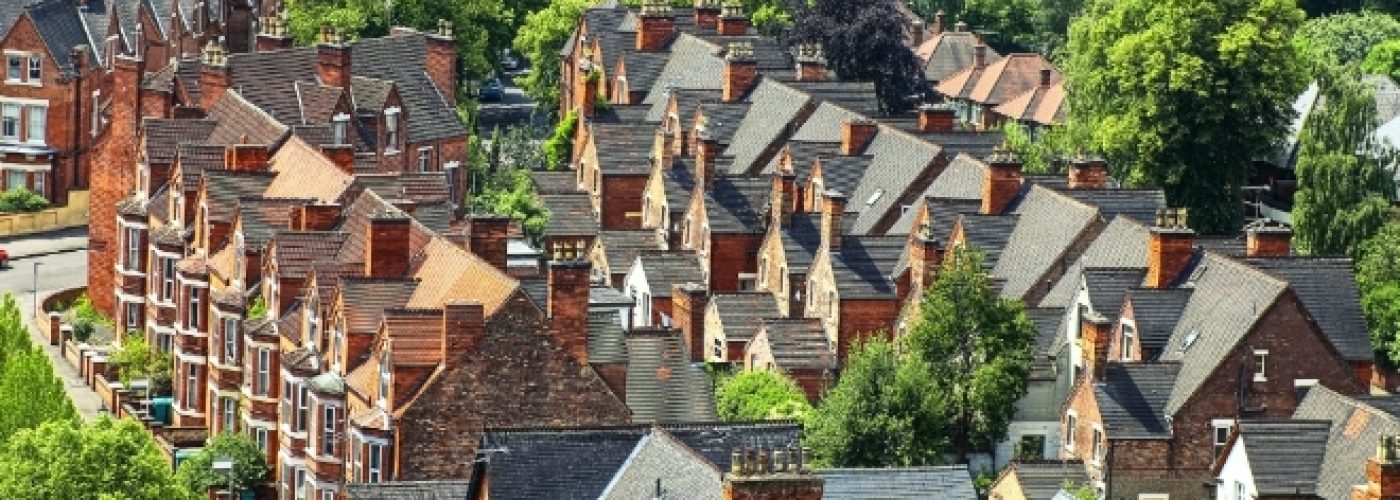

City house price growth sees “marked slowdown” in Q2

There has been a “marked slowdown” in house price growth over the last three months, led by a deceleration in London and other high value cities across the south of England, according to the latest Hometrack UK Cities House Price Index.

The annual rate of city house price inflation slowed to 9.5% in July. In the three months to July house prices in London rose by just 2.1%, the lowest quarterly rate since February 2015.

Bristol, which is the fastest growing city over the last 12 months, saw growth over the last three months slow to 2.6% from a recent high of 5.0% in May 2016.

Conversely, house price inflation in many large regional cities in the north of England and Scotland “shows no signs of slowing”, with Hometrack saying that the rate of growth in North and Scotland is now set to outpace London and the South.

The rate of annual house price growth in Leeds, Manchester, Birmingham, Liverpool and Nottingham continues to rise by between 7% and 8%. Focusing on activity in the last quarter, the highest rates of growth have been registered in lower value, high yielding cities where prices are rising of a lower base – Glasgow (5.2%), Liverpool (4.4%), Manchester and Nottingham (3.4%).

Richard Donnell, Insight Director at Hometrack, said: “In the absence of adverse economic trends impacting employment and mortgage rates, the near term outlook is for a continued slowdown in London towards mid-single digit growth. The slowdown in London is being seen across the market is not accounted for by seasonal factors with weaker demand from home owners and investors as supply grows. This analysis suggests London house price growth will continue to slow over the rest of the year. In contrast, northern regional cities will continue to register stable growth rates as households’ benefit from record low mortgages rates and affordability remains attractive.

“We continue to believe that turnover will register the brunt of the slowdown in London. In the face of lower sales volumes agents will look to re-price stock in line with what buyers are prepared, and can afford to pay. Past experience shows that this process can run for as long as 6 months and relies, in part, in how quickly sellers are willing to adjust to what buyers are prepared to pay.”