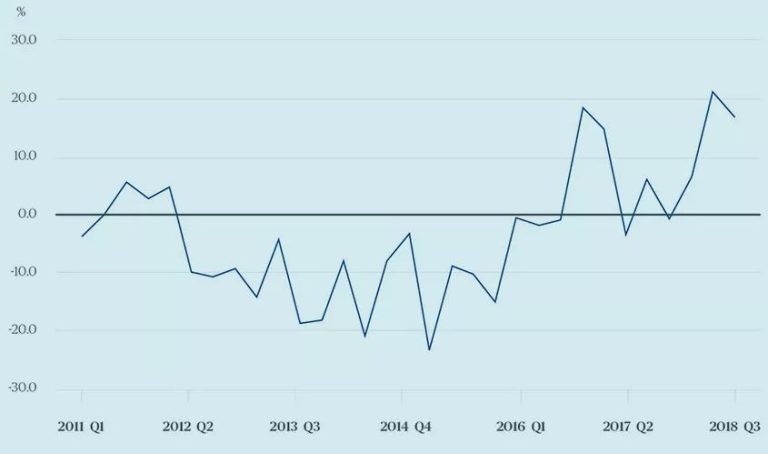

The UK construction industry should beware insolvencies as demand weakens and margins are squeezed, warns UK consultant Turner & Townsend. Its latest market analysis points to falling demand, rising input costs and lower margins, and notes that the number of construction insolvencies far outstrips those in retail. The confusion over Brexit keeps persisting and contractors expect tender prices to increase 2.9% in 2019, outstripped by increasing materials costs of 5.3% and labour costs rising 4.5%. Only 28.4% of contractors expect the market to improve, against 42.1% prior to the Brexit vote in June 2016. According to official data, construction witnessed the highest insolvency rate of any UK economic sector, with 2,924 insolvencies recorded in the 12 months to the end of September 2018. This figure is 28.8% higher than the UK’s struggling retail sector. Turner & Townsend thinks that the underlying cause is weakening demand in construction. Despite a small 3.4% rise on the previous quarter, new orders in Q3 2018 were down almost a third (30.8%) on the high levels seen in 2017. As a result, Turner & Townsend’s latest UK market intelligence report finds that half of contractors (50.5%) surveyed were experiencing lukewarm tendering conditions, reporting increased competition and moderate price growth. The trends are hurting profit margins. The analysis shows median margins for tier one contractors standing at 3% and 5% for tier two contractors. Since the start of 2016, median tier one margins have shrunk by a quarter and tier two margins by half, leading Turner & Townsend to warn of a heightened risk of insolvency. “So much rests on the Brexit withdrawal agreement and there remain risks of further decreases in demand, coupled with increases in the costs of materials and labour from the continent and elsewhere. Contractors’ already-thin margins could clearly come under further pressure, ” said Paul Connolly, UK managing director of cost management. “It’s essential for clients to be proactive about these risks – monitoring for warning signs, undertaking wide-ranging due diligence during procurement, and using project controls to pre-empt and correct problems at an early stage. It’s about checking and challenging the supply chain, but also collaborating – understand suppliers’ pressures and concerns, as well as holding them to account,” he added. Turner & Townsend’s report outlines the steps clients should take in terms of watching for warning signs, due diligence, pre-emption of problems, and creating a resilient client-supplier dynamic.