Many of us understand how much it costs to build a property. But when it comes to the purchasing costs, we don’t always know a huge amount. That said, we should. That’s because how much a building costs to purchase matters a lot to clients. They want to know that they are getting a good return on their investment.

So what purchase costs do we need to take into account following the construction of a building. Perhaps the biggest issue is the cost of capital for the downpayment – usually around 20 percent for most commercial projects. Those buying commercial buildings will need to consider the opportunity cost of putting this money into commercial real estate equity versus investing it elsewhere, such as the stock market.

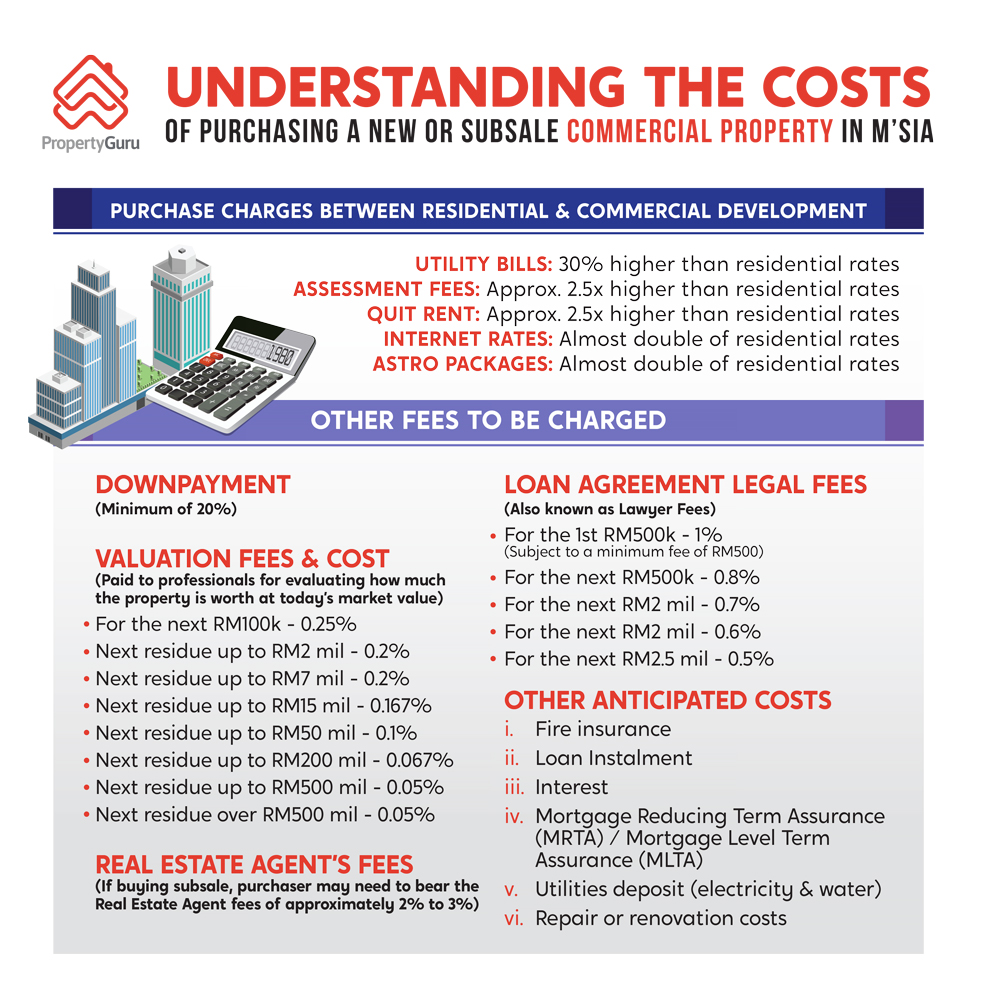

Other cost considerations include valuation fees and loan agreement legal fees. As the following infographic shows, these can be up to 1 percent of the purchase price of the construction. There are many other costs too, such as fire insurance, loan instalments, interest and utility deposits for electricity and water.

It’s also worth noting that commercial rates for utilities are often considerably higher than they are for residential properties. So when clients consider the levelised cost of purchasing a new construction, they will take this into account as well.

If all this sounds a little complicated, don’t worry. The following infographic breaks it down. It shows the likely costs of purchasing a property and how much you’re likely to spend in a country like Malaysia.