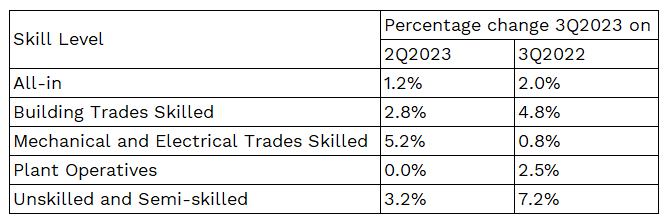

Construction site wages increased by an average of 2% in 3Q 2023 compared to 3Q 2022, the latest data from the Hays/BCIS Site Wage Cost Indices, published by the Building Cost Information Service shows.

This represents the lowest annual growth since 2Q 2021. Against the second quarter of 2023, average site wages were up by 1.2%.

Source: BCIS, Hays

While the greatest annual growth was seen among unskilled and semi-skilled workers, whose pay was on average 7.2% higher than in 3Q 2022, there were significant differences between skill categories, perhaps reflective of movement in national wage awards agreed among trades over the summer.

Building trades skilled workers’ pay was up by 4.8% on 3Q 2022 while, on a quarterly basis, Mechanical and Electrical (M&E) Trades Skilled workers saw the biggest rise on 2Q 2023, with a 5.2% increase.

BCIS solutions architect, Paul Burrows, who compiles the indices for BCIS and Hays, said: “BATJIC and the CIJC respectively agreed 8.0% and 7.6% increases for builders in the summer, while a 7% rise is due in January 2024 for the electrical contracting industry under the JIB collective agreement. After a 3% increase for plumbers under JIB-PMES in England in January 2023, a 7% rise is planned for January 2024.

“As salaried workers have sought inflation-matching pay, so too do other workers on site look for better rates, particularly when there have been uplifts in wage awards.

“The underlying data also suggests lower demand for groundworkers is reflected in site wages, which, given the delayed starts to projects and seasonal conditions, is not surprising.”

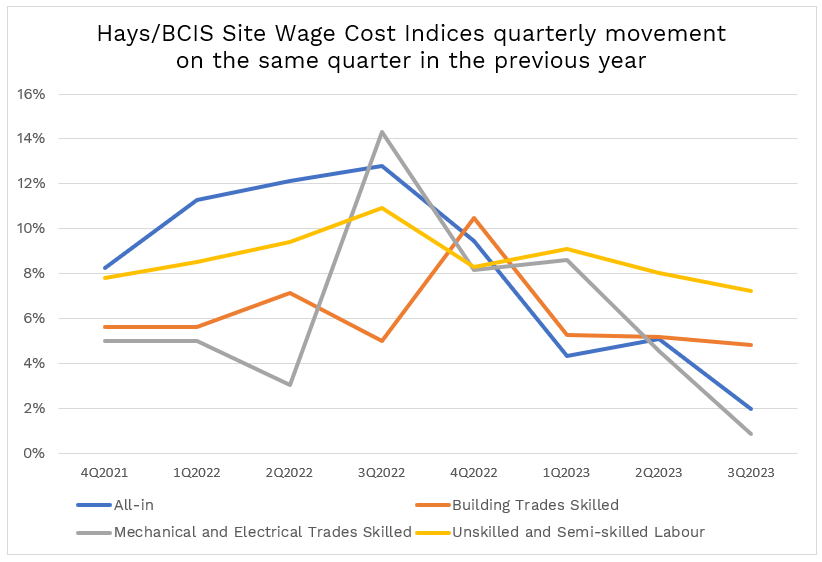

Source: BCIS, Hays

Hays also reported fewer construction job placements in 3Q 2023, continuing a decrease which has been seen since 2Q 2021.

Burrows said: “At the moment we have these opposing factors of both declining construction volume in new work, which we are no doubt seeing in the frequency of placements in the industry, and a skills shortage.

“In some cases, I’m sure there’s an element of contractors retaining some of the agency workers they have on site on PAYE, so that they have the skilled labour available when they need it. At the same time, with the cost of living that all workers face, everyone on site is determined to see wage rises.”

Latest figures from ONS show that while overall construction output in 3Q2023 was slightly up, by 0.1%, it was driven by repair and maintenance work, with new work down 0.3% on 2Q 2023. While new orders, based on submitted planning applications in 3Q 2023, were up by 3.9% on 2Q2023, on the year they were down 20%, and by 38.5% specifically in infrastructure.

The Hays/BCIS Site Wage Cost Indices are produced using market data from Hays Recruitment, generally representing short-term labour requirements for immediate fulfilment. Because of this, the indexes tend to be more volatile and faster to react to changes in market conditions than other labour indices.

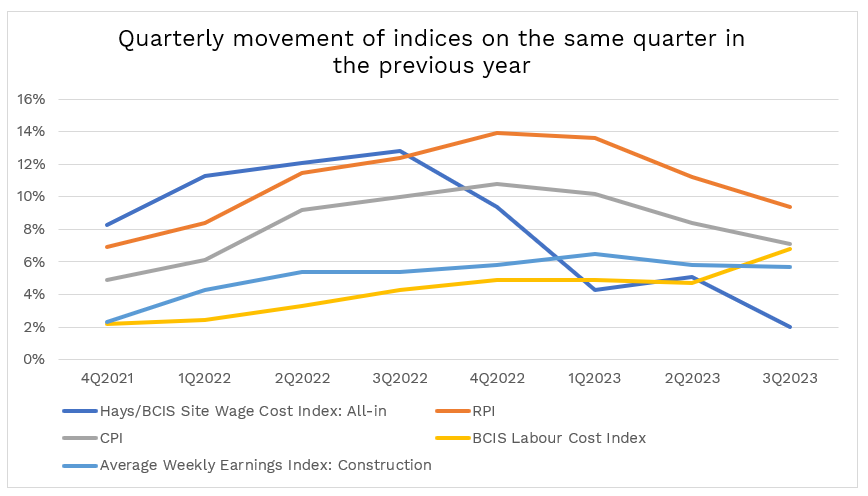

The BCIS Labour Cost Index, for example, incorporates the movement in nationally agreed wage awards, which are generally updated annually, across the industry.

Source: BCIS, Hays, ONS

For more information about BCIS, visit the website at www.bcis.co.uk.

Building, Design & Construction Magazine | The Choice of Industry Professionals