- Commercial and public buildings are more energy intensive per m2 than residential property, making energy efficiency initiatives a high priority for meeting decarbonisation targets.

- Yet, challenging economic times are causing investment in necessary retrofit technologies to slow.

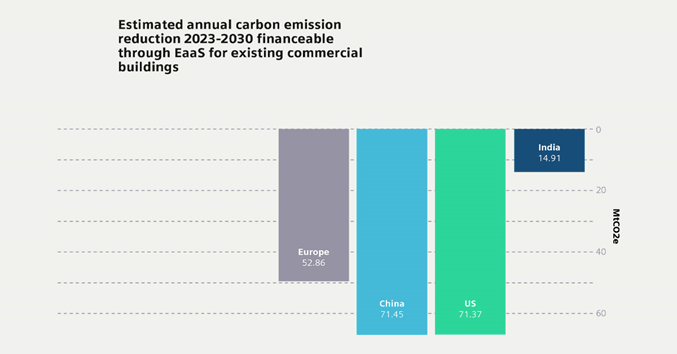

- New research from Siemens Financial Services (SFS) estimates the volume of carbon emissions that could be reduced in the USA, Europe, China and India between now and 2030 through the wider deployment of energy-efficiency-as-a-service schemes.

- These flexible financing arrangements can secure operational cost reductions without putting pressure on capital resources, avoid putting capital at risk, and ensure expected savings are realised.

Retrofit for Purpose – a new insight study from Siemens Financial Services (SFS) – assesses the volume of carbon emissions buildings owners could save through energy-efficiency-as-a-service schemes.

Specifically, the paper estimates emissions for the world’s four highest-volume emitter geographies – USA (71.35 MtCO2e), China (71.45), Europe (52.86), and India (14.91). Given these four areas are responsible for the majority of global CO2 emissions,[i] this equates to more than 8% of global annual CO2 emissions reduction targets, as defined by the International Panel on Climate Change (IPCC).

Renovating existing building stock to a zero-carbon-ready level is a key priority for achieving the sector’s decarbonization targets. However, rising inflation, hardening interest rates, increased fuel costs, and supply chain disruption are all factors negatively impacting adoption rates. The report therefore evidences the enabling role of flexible private sector financing arrangements to maintain crucial investment momentum, drawing on many real-world examples of implementation from around the globe.

Comprehensive retrofits of commercial buildings – including offices, hospitals, factories, warehouses, and educational establishments – can reduce their energy use by up to 40 percent but are not happening anywhere near the scale needed to meet climate goals, notes the report. This is likely due to the considerable investment required to retrofit new technologies.

That’s where arrangements known as energy-efficiency-as-a-service are helping private and public sector organizations to retrofit the existing non-residential building stock in an affordable and cash-flow friendly way. These innovative financing schemes can secure operational cost reductions without putting pressure on capital resources, avoid putting capital at risk, and ensure expected savings are realized. At the technology component level, financing tools are available to help vendors and distributors add value with cash flow capabilities for their buyers. For larger installations or systems, smart financing arrangements can be flexed and tailored to align costs with the rate of benefit gained from the energy-efficient technology.

“With climate targets looming large, it’s important we continue support and enable the decarbonization of buildings. Not only are they a serious contributor to global greenhouse gas emissions, if left unchecked these emissions are projected to double by 2050,” says Toby Horne, Siemens Infrastructure Financing Partner, Siemens Financial Services, UK. “Specialist finance solutions are intelligently designed to factor in savings, making them budget-friendly enablers of the green transition.”

Methodology

Data from national/regional statistical institutes on annual energy consumption by non-residential buildings built prior to 2010 was used to model CO2 emissions of buildings likely to benefit from deep retrofit for energy-efficiency. This was then reduced by highest likely implementation levels of such deep retrofit. Likely energy savings from deep retrofit were calculated using the lowest end of official average ranges. The resulting figures provide a highly conservative annual estimate of the energy savings achievable through deep retrofit, which can be financed through energy-efficiency-as-a-service financing techniques.

Download a copy of the Whitepaper: www.siemens.com/smart-buildings-retrofit

Visit for further information about SFS: www.siemens.com/finance

Follow us on LinkedIn: www.linkedin.com/showcase/siemens-financial-services

[i] https://www.visualcapitalist.com/carbon-emissions-by-country-2022/

Building, Design & Construction Magazine | The Choice of Industry Professionals