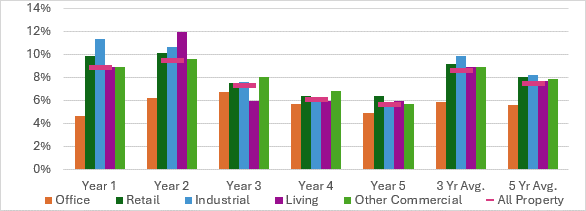

abrdn has raised its outlook on the real estate sector, forecasting a new growth phase driven by renewed REIT performance, a stable interest rate environment, and strong demand for quality rental assets. In its latest Q4 Real Estate House View, abrdn upgraded its investment stance from neutral to overweight, marking the first positive shift since June 2022. With annual total returns for UK real estate projected to reach 8.6% over the next three years, the firm expects a marked recovery.

Market Rebound and Key Drivers

Anne Breen, abrdn’s Global Head of Real Estate, explained that recent indicators support optimism: “Our ongoing monitoring of the real estate market shows a pivot to growth, spurred by increased capital mobilisation in REITs, favourable interest rates, and resilient rental demand for quality assets.” abrdn has identified logistics, residential, and select alternatives as sectors with promising return potential, noting that even office markets are showing renewed energy.

The Autumn Budget, which could introduce tighter fiscal policies and potential reforms to capital gains and inheritance tax, places greater importance on private capital for addressing the UK’s housing and infrastructure needs. Despite this, abrdn expects private investment to drive UK real estate growth.

REITs and Direct Real Estate on the Rise

REITs, a useful predictor of direct real estate performance, have signalled renewed confidence by focusing on growth rather than debt reduction. In Europe, REITs are issuing equity and debt, highlighting the transition from a refinancing phase to one of expansion. In direct real estate, competitive bidding is heating up, with residential rents rising by 6.7% and logistics by 6.6% year-on-year, signalling steady demand across sectors. Furthermore, the forecasted yield premium on real estate is proving increasingly attractive as the Bank of England’s expected gradual interest rate cuts—anticipated at around 100 basis points in 2025—support investor entry into the market.

The Office Sector Sees Renewed Demand

The office market, particularly in London’s West End, is experiencing increased demand, especially for high-quality spaces. Cities like Bristol and Manchester are also seeing strong growth in prime office rents, reflecting a trend among tenants to prioritise quality as they consolidate premises. While global economic and geopolitical challenges persist, the office sector shows capacity for resilience, especially as valuations stabilise in the UK and European markets.

Sector Outlooks

- Industrial and Logistics: abrdn sees yields stabilising here, with strong fundamentals drawing investor interest, although growth will hinge on capturing rental value increases.

- Residential: abrdn notes that rental growth remains steady in the private rental sector, despite signs of peaking. However, with sustained demand, rental values are set to hold.

- Retail Warehouses: This segment is emerging as the preferred retail investment due to appealing yields, low vacancies, and stable net operating income.

As sectors such as industrial and logistics continue to offer strong returns, abrdn emphasises the importance of quality and sustainability in property selection. Compliance with Minimum Energy Efficiency Standards (MEES) and Net Zero targets will be critical, with assets that have already adapted to these standards expected to lead in future investor and occupier interest.

By addressing decarbonisation and retrofit costs upfront, abrdn sees an opportunity for investors to capture both financial and environmental value in a rebounding market.

Building, Design & Construction Magazine | The Choice of Industry Professionals