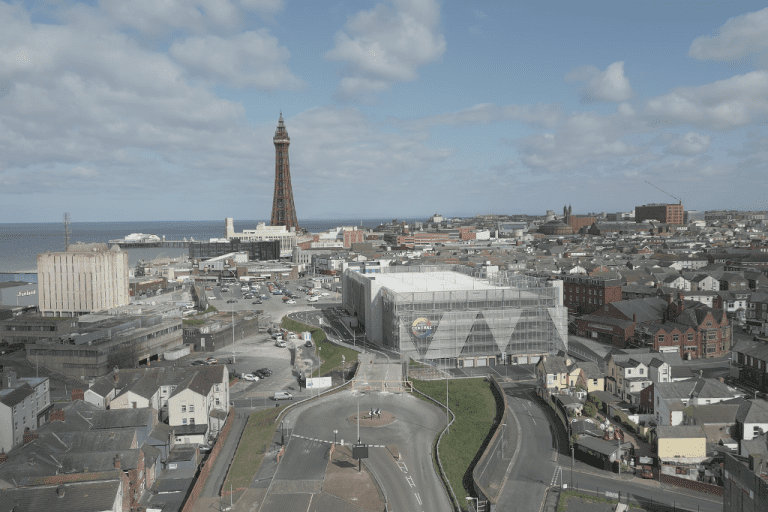

Today, Malaysian engineering, property and infrastructure group Gamuda Berhad and London-based real estate investor Castleforge marked the next stage in their £1.2bn redevelopment of 75 London Wall in the City of London, with a groundbreaking ceremony and the signing of one of London’s largest property development loans in recent years, valued at £500 million. The event was led by Dato’ Lin Yun Ling, Gamuda Group Managing Director, and Michael Kovacs, Castleforge Founding Partner. They were joined by Gus Wiseman, Global Head of Investor Relations for the UK Government and Howard Dawber, Deputy London Mayor. Over 80 attendees were present, including financiers, property agents, and a range of property development and built environment specialists. The investment is another signal of support from Gamuda for the UK property market, with the group viewing London as a key strategic destination for real estate investment. Since 2022, Gamuda has committed a total gross development value of £1.4 billion to the UK market, encompassing prime commercial office assets, residential properties and Purpose-Built Student Accommodation (PBSA). The 75 London Wall project is the largest investment for Gamuda in the UK thus far. Complementing this is Castleforge’s commitment to delivering best-in-class workspaces that prioritise sustainability and tenant well-being which set new standards for the adaptive reuse of office buildings in the City of London. The site has received full planning consent in June 2024 and construction has begun. Upon full redevelopment expected in 2027, 75 London Wall will be a grade-A sustainable top-tier office with a net lettable area of more than 450,000 square feet with the best ESG standards – BREEAM ‘Outstanding’, WELL Core ‘Platinum’, and NABERS UK 5 Star Design. This landmark redevelopment will transform the building into a sustainable commercial hub in one of the world’s most competitive business districts. The ground floor will feature new commercial units, alongside a cultural forum space for events, performances, and public speaking, alongside open, green spaces. Dato’ Lin Yun Ling, Gamuda Group Managing Director said, “Our acquisition of this building in 2023 stemmed from the “Flight to Quality” to top grade office spaces in the real estate market. Multinational corporations are drawn to London, the epicentre of Britain’s economy and home to a huge proportion of its primary export – global services. This has driven a surge in demand for premium offices, linking quality workplaces to higher productivity. With a limited supply of best-in-class ESG spaces, rental growth remains strong, making 75 London Wall a standout investment.” Michael Kovacs, Founding Partner of Castleforge, said “We were delighted to welcome Dato’ Lin, Gus Wiseman and Howard Dawber to the site today to witness the progress being made on a project that we believe will set a new benchmark for sustainable, expertly designed office developments in London. In an increasingly competitive landscape, we know that 75 London Wall will stand out as a true best-in-class office development for those who want to attract the best talent in and around our city.” Gus Wiseman, Head of Investor Relations for the UK Government, said “We welcome this show of confidence in the UK economy by Gamuda and Castleforge. In years to come, this investment will create a busy trading floor for our world-leading financial services industry. This will create jobs in construction and at full occupancy, will house over 5,000 workers. Redevelopment projects such as 75 London Wall are vital to this Government’s mission to achieve the fastest growth in the G7.” Ravi Stickney, Cheyne Capital Managing Partner & CIO, Real Estate said “Following our £150million loan for the acquisition of 75 London Wall in 2023, we are delighted to extend our support to Gamuda and Castleforge with a £500m loan for its redevelopment. At Cheyne, we remain committed to financing the creation of productive and sustainable assets to support the growth of the UK’s vibrant economy. We are therefore thrilled with the significant vote of confidence that Gamuda has shown in London.” Building, Design & Construction Magazine | The Choice of Industry Professionals