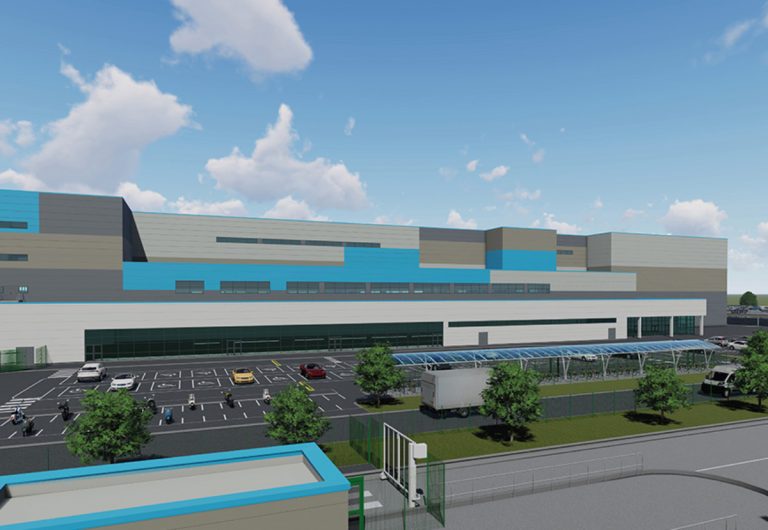

Tritax Big Box REIT plc (Tritax Big Box or the Company) announces that it has received planning consent* and exchanged contracts with a world leading on-line retailer (the Customer) to pre-let a new Mega Box logistics building. The pre-let and planning consent (the Project) covers the Phase 2 and part of Phase 3 plots of the Company’s Littlebrook, Dartford development, comprising a c.2.3 million sq ft logistics building on 35.5 acres within London’s orbital M25 motorway and next to critical transport infrastructure. Leveraging existing customer relationships to maximise development potential In line with its strategy, Tritax Big Box worked closely with the Customer, an existing tenant of other Big Box assets of the Company, to understand their current and future requirements and develop an optimal logistics solution from Littlebrook’s c.97 net acres of development land, acquired in July 2017. The site will play a key role in the Customer’s local and national distribution and fulfilment network in addition to delivering economic and employment benefits to the area. Following completion, the Customer will occupy over 7 million sq ft of high-quality Big Box logistics space within the Company’s portfolio representing c.19% of total contracted rent roll. The Littlebrook development project, formerly the site of a decommissioned power station, is adjacent to the QE2 Bridge, Dartford Tunnel and on the south bank of the River Thames and has the potential to become one of London’s largest Big Box logistics parks in a critical “last journey” location inside the M25. This is a rare asset so close to the heart of London, benefiting from exceptional transport connectivity via motorway, rail and water, excellent infrastructure, significant power provision and a robust labour market. State of the art sustainable logistics building, meeting the needs of the market The Company, together with its development partner, Bericote Properties (the Developer), has successfully secured detailed planning permission* from Dartford Borough Council for this pre-let development. With practical completion expected in Summer 2021, this highly sustainable building will target an Excellent BREEAM and EPC A ratings, with key features including: Gross internal floor area of c.2.3 million sq ft, including three structural mezzanine floors Clear internal height of 20 metres High levels of automation through capital investment by the Customer Substantial 3.5 MW solar PV scheme Delivering attractive returns to investors The Project development will deliver attractive returns to investors based upon: A new 20-year lease, subject to annual upward only rent reviews indexed to the Consumer Prices Index (collared at 1% pa and capped at 3% pa) with the first review in Summer 2022. The Company will benefit from a licence fee from the Developer during the construction period equivalent to the annual rent payable by the Customer following completion of the building. The total development cost for the delivery of this project, including land and demolition, is expected to be £205 million. This development has been committed to using existing credit facilities, with a further £164 million costs to completion. In total, this Project delivers a yield on cost which is in-line with the stated development target for the site and enhances the Company’s income. The completion of this Project is expected to achieve the Company’s original expectations for the overall development profit on the Littlebrook site. Colin Godfrey, CEO, Fund Management, commented: “The signing of this pre-let for a 2.3 million sq ft prime logistics facility is a great achievement and demonstrates our strategy is working. By combining our deep understanding of the market and long-standing customer relationships forged across existing high-quality assets with an attractive development portfolio, we are creating significant value for our customers and investors. Furthermore, recent macro events are accelerating substantial tailwinds for our business through the ongoing adoption of e-commerce platforms as consumers increasingly shop online. “This enhances our existing portfolio with a substantial, prime and sustainable logistics investment at an attractive yield on cost as we advance our plans to transform this disused brownfield site into a new premium logistics park. Working with our partner Bericote, the development of the site will not only deliver much sought-after high specification logistics space for London, but will also bring enhanced local infrastructure and significant employment opportunities to the local area, strengthening its economic growth.”