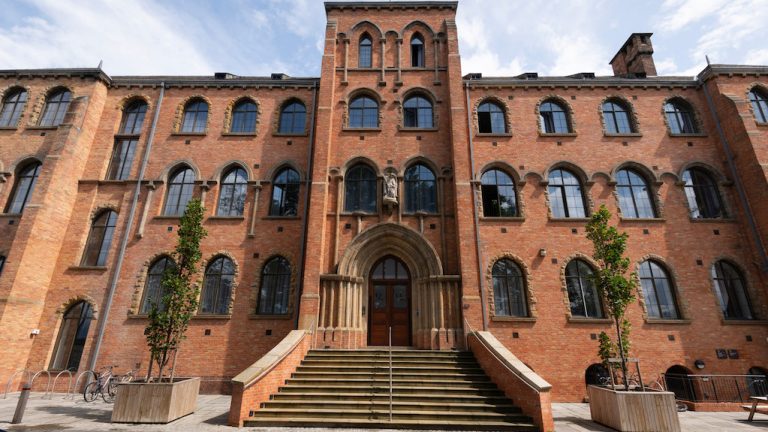

The popularity of holiday lets in the UK has boomed in recent years, particularly since the crackdown on financial breaks for buy-to-let landlords. The coronavirus pandemic is pushing even more landlords to consider switching to holiday lets, as an increasing number of Brits decide to holiday closer to home and stay in the UK. Holiday lets can be a great investment for landlords who understand the market, but it’s important to know what you’re taking on before investing in a holiday let. Holiday lets require a different management style than traditional residential properties, as well as different financing options and tax regulations. Do people still vacation in the UK? Absolutely. According to research conducted by Sykes Cottages, two thirds (66%) of Brits enjoyed holidays in the UK in 2018 compared to 56% in 2017. In 2019, respondents said they planned to take an average of three UK trips in 2019. With most UK breaks being shorter but more frequent than overseas trips, this means there’s still a healthy market for domestic tourism. And, of course, this doesn’t even take into consideration the millions of tourists travelling to Britain every year from outside the UK. Tourism is, in fact, the fastest growing industry in the UK, with experts predicting the industry will expand by 3.8% a year between now and 2025. Visitors to the UK from overseas reached a record-breaking 7 million in 2018, a 4.4% increase on 2017. The UK tourism industry is not just strong, but it’s also growing every year. Are holiday lets a good investment? Holiday lets can be a great investment. Rental income from short-term holiday lets is usually significantly higher than rental income from long-term residential lets, although the difference between the two isn’t as high as it first seems. Mortgage rates for holiday lets are usually charged at a higher rate, meaning more interest is paid every month, and running costs are higher because holidays lets need to be cleaned and tidied between guests. Lovemoney have crunched the numbers, comparing profits between holiday lets and residential lets in both Whitby and Liverpool. These figures show that holiday lets in both the tourist hotspot and the city centre location fare better than residential lets despite higher maintenance costs and fees. How to finance a holiday let One complicating factor for investors considering holiday lets is that financing a holiday let can be a little harder than financing a residential property. Holiday lets aren’t covered by standard buy-to-let mortgages, which usually stipulate that a property is to be let on an assured shorthold tenancy agreement with a minimum fixed term of six months. Instead, some lenders now offer holiday let mortgages designed specifically for these properties, although there are not as many products available as there are in the buy-to-let market and holiday lets are seen as a riskier venture due to their seasonal nature, which means interest rates tend to be higher, too. There are various types of holiday let mortgages available depending on the lender, including fixed-rate mortgages, discounted rate mortgages, and flexible rate mortgages. Holiday let mortgages are usually offered on an interest-only basis. Because holiday let mortgages are deemed more risky by lenders, most lenders will request a 25% deposit minimum, with better interest rates available for those borrowers with bigger deposits. Most lenders will also want to see your projected letting income, and this should be at least 125% of the annual mortgage interest payments you will need to cover. Other options for financing a holiday let are available, including remortgaging your existing home to release equity or even taking out a personal loan. However, it’s important to be very careful before making decisions like this: run through the numbers to make sure your decision is financially profitable, and be conservative when projecting annual profit margins on any rental property or holiday let. Top 5 holiday let locations in the UK If you’re thinking of purchasing a furnished holiday let in the UK, it’s important to do your research and buy a property somewhere which offers great yields. You may want to choose a let nearby, particularly if you’re planning to manage and maintain the property yourself, or you might choose a let in another part of the UK because it offers higher ROI and a place to get away to yourself. Here are five sound bets for holiday lets in the UK. 1. London If you’re considering a city centre holiday let, you can’t go wrong with London – assuming you can afford the high price tag. 53% of overseas tourism spend occurs in London, and the city’s international fame guarantees a stable supply of tourists for years to come. 2. Dundee It might not be the obvious choice, but Dundee has topped the list of the most profitable places in the UK in terms of holiday let rental yields, offering 15.1% average short term rental yields in 2019. This is likely due to the city’s recent rebirth as the cultural capital of Scotland, with the opening of the V&A Dundee. 3. The Lake District For a more traditional location where a holiday let can double as a holiday home for landlords, buying in the Lake District will never be a bad move. The Lake District welcomes over 19 million visitors every year making it a solid choice for canny investors. 4. North Wales Wales is another strong contender. Property prices are still relatively affordable in most of the country, and yet with scenic spots such as Snowdonia and the Brecon Beacons welcoming millions of visitors every year, there’s plenty of demand for holiday lets in North Wales. 10.2 million people visited Wales in 2018, and buying a holiday let in a tourist hot spot such as one of many scenic villages around Snowdonia is a sure-fire way to get great yields on bargain properties. 5. Cornwall Cornwall has long been considered the UK’s very own Costa Del Sol, and the numbers show that this is still the case.