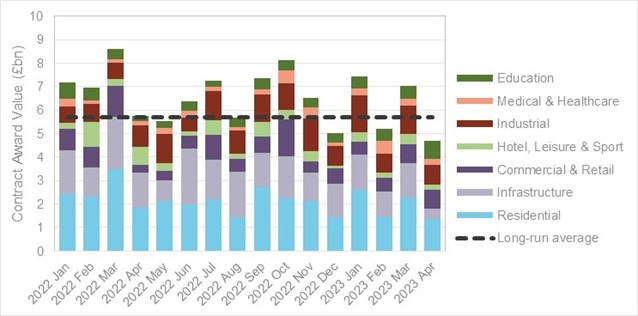

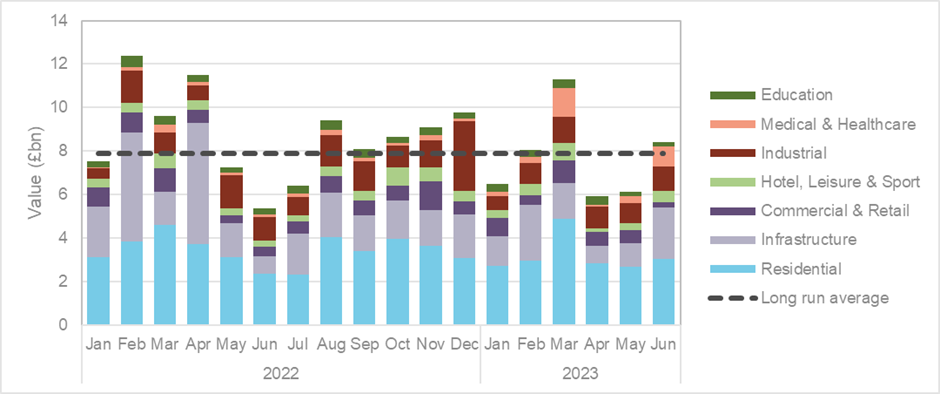

Planning applications for infrastructure have plummeted 45% so far in Q2 and contract awards have fallen 32% according to the latest analysis from Barbour ABI.

Government-backed Infrastructure projects have previously provided some relief to the poor economic performance of the sector, as house builders and commercial contractors struggled.

Meanwhile, the smaller Industrial and healthcare sectors have also fallen 45% and 50% in the same period, following a positive start to the year.

Overall, contract awards in June confirmed the new lower trajectory with £5.3bn, the third month in a row of below-average levels. Activity fell by 21% compared to Q1, averaging £5.2bn per month compared to £6.5bn in Q1 and including a 10% fall in residential activity.

“We are seeing the positive impact of large Government investment in infrastructure projects after COVID begin to fade for the first time in our latest analysis.” Commented Barbour ABI chief economist Tom Hall.

“This will have knock-on effects for the industry which is already struggling with high interest rates and inflated construction costs, hitting new businesses which previously might have been shielded due to the nature of their portfolios.”

Early Planning stages

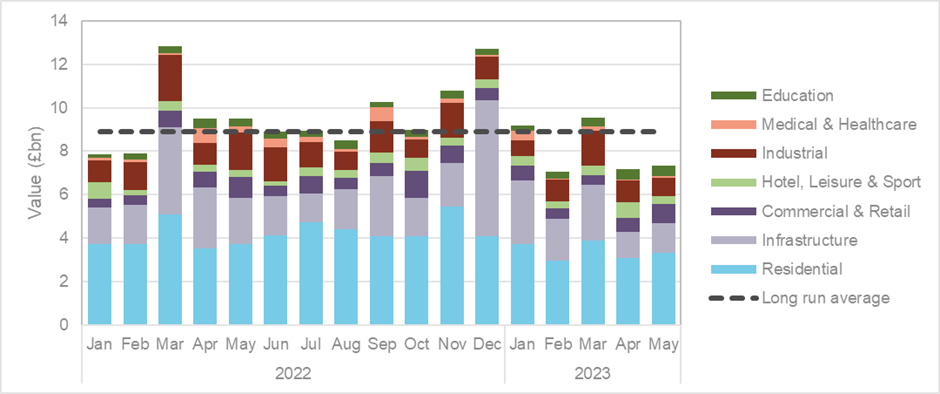

It was also another subdued month across earlier planning stages with a small recovery for planning approvals in June failing to save a very weak second quarter which saw a steep 20% fall. The residential sector suffered the lowest quarterly result since 2016.

For planning applications activity has now been very low for three months out of the last four. The main element that has changed over the last few months is the fall in the infrastructure sector, by 50% in some areas compared to 2022.

“June’s planning activity provided further evidence, if it was needed, of the likely slowdown in construction over the second half of the year driven by inflation, rising interest rates and lack of consumer confidence. Residential construction planning remains weak and continues to suggest house building will be greatly reduced over the year whilst new weaknesses are emerging elsewhere.”

Find out more at www.barbour-abi.com

Building, Design & Construction Magazine | The Choice of Industry Professionals