The article was written with the help of Chris Atkins, a Chief Innovation Officer at The Gap Partnership.

This special report on the hot topic of biflation examines the paradoxical state of affairs in which both inflation and deflation occur in the economy. Navigating these challenging and complex conditions requires a range of highly tuned commercial skills. This article shares a four-point plan for negotiators to equip themselves with tools and strategies to face into biflation.

Increasingly our clients are coming to us because they are caught in the biflation vice: pressure from governments and consumers to reverse the significant inflationary pricing we have experienced over recent years while still trying to recoup current and historical commodity price increases.

So, what are we seeing and how can we most effectively address this paradox?

The current situation

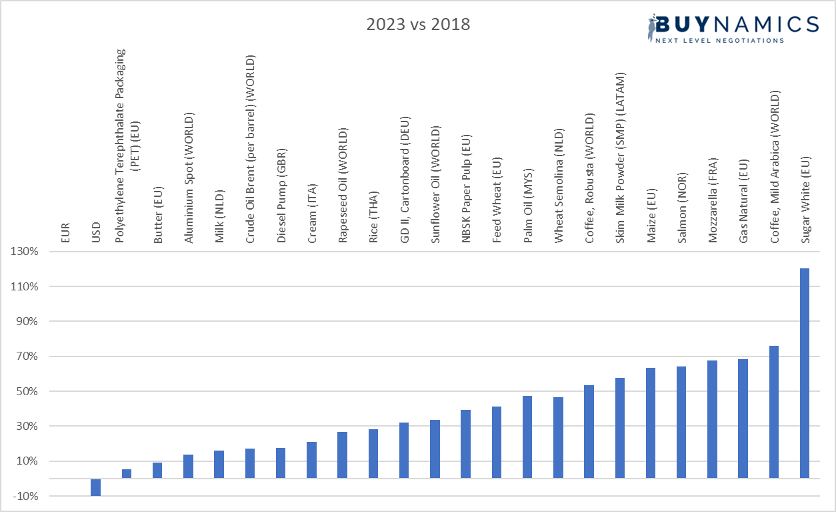

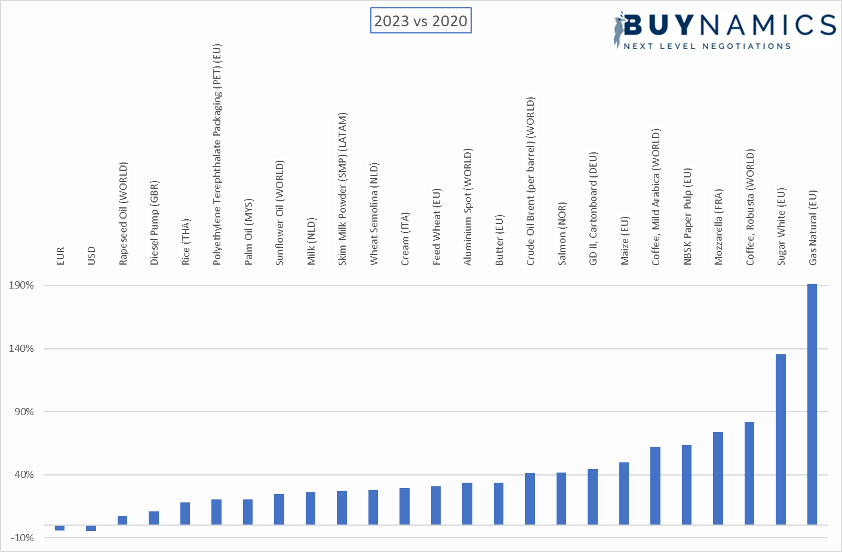

First, there is a perception that commodity cost increases have halted. Unfortunately, that is not the case. There is undoubtedly a slowing and, in some cases, a reversal of the shocking escalation that we saw last year. But in the longer term, the trend remains upwards.

It is also true, as can be seen from this shorter-term chart, that certain critical commodities continue to rise sharply.

Second – and here’s the real paradox – many consumer goods companies are reporting that offtake remains strong despite inflation, so accepted price elasticity models are nullified by the ubiquity and scale of the increases we have seen.

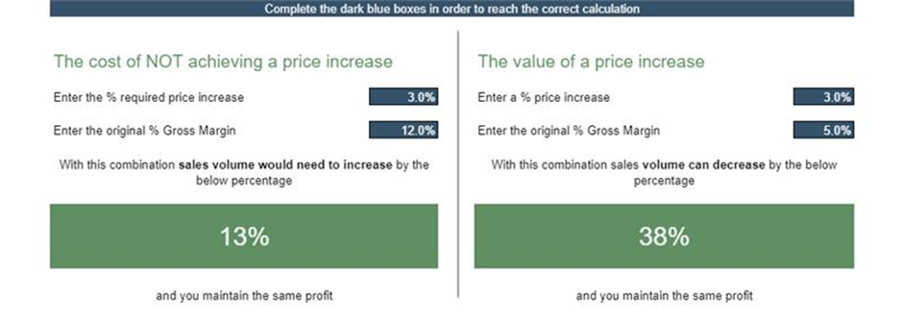

If this paradox is reality, it’s highly unlikely that reductions in consumer price will produce volume gains, and we know from using our cost increase cost decrease profit calculator that, even in ‘normal’ economic conditions it’s rare to offset price decreases by real volume-related profit benefits.

This calculator helps you to quantify, in simple terms, the value of any potential price increase or the cost in margin absorption of missing your target. It makes compelling reading!

In this reality, both the retailer and their suppliers are likely to lose margin, which is not good in an industry already under wage and margin pressure. You could call it a true lose-lose situation.

What to do?

It would be easy to ignore biflation. Consumer goods companies have become increasingly confident and adept at negotiating price increases, not just annually, but several times in a year. And these increases have been accepted by the consumer with little change in buying behavior.

This year it will be different. The pressures are different, attitudes are different, and the power balance has shifted.

With that in mind, here are some points to consider:

ONE: Don’t become complacent. The landscape has changed, but do you know what aspects have altered and by how much? What is the real situation of your counterparty and how can you turn this from a lose-lose to a win-win?

TWO: Get forensic. Sweeping statements about the scale or even the reality of cost of goods increases are being more scientifically challenged with increasingly sophisticated should-cost modelling. Don’t find yourself on the back foot of your counterparty’s analysis. It is critical to understand your cost drivers and margin enhancers.

THREE: Be rigorous. Market dynamics, competitor approaches, inflation fatigue, government intervention, consumer sentiment: all of these will have an impact on the trajectory and success of your negotiations. Ignore them at your peril and carefully monitor the ebb and flow of the marketplace to identify the optimum timing. Negotiation planning should not be a function of your corporate calendar, but of optimizing results.

FOUR: Unify communications. There is an increasing need for external communications teams to be involved in planning, so they are aware, aligned and prepared for any resulting trade or mainstream publicity as, increasingly, positioning is played out in the public domain. Additionally, check the messaging of your corporate communications. Annual reports paint the best picture of profitability. How will your counterparties read those messages? These considerations will be the difference between successfully navigating the turbulent waters of biflation, or getting caught in the maelstrom.

Only two questions remain. How ready are you? Have you started planning yet?

To find out more about how The Gap Partnership can support you with the challenges that biflation presents, please get in touch. We’d be delighted to help.