- Construction spending at highest levels in months.

- Infrastructure is a star performer, reaching highest spending level in over four years.

- Commercial has a stellar month as mega projects are confirmed.

- Businesses remain coy on new planning applications as they await better economic news.

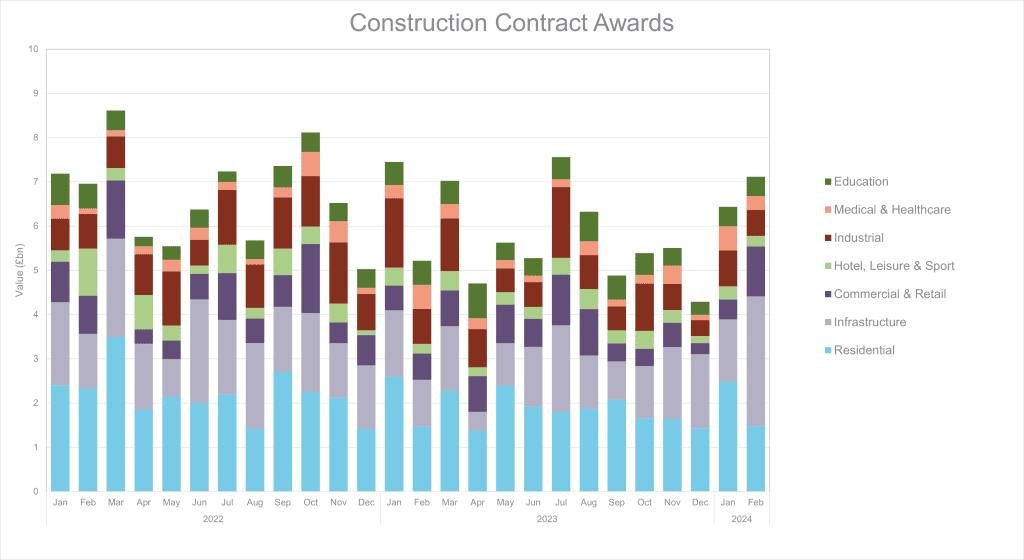

February saw construction contract awards reaching £7.1bn, their highest level in seven months, according to Barbour ABI’s latest data. An 11% increase in contract awards in February appeared to confirm the increased spending trend reported by Barbour in January, as industry spenders continued to flex their muscles.

Infrastructure was the star performer with spending increasing by 108% on January. Contracts for two road tunnels under the Thames for the Lower Thames Crossing in Kent were agreed with a value of £1.3bn.

Better prospects are also in store for the commercial sector as the significant headwinds faced since the onset of the global pandemic begin to ease.

A 152% increase in spending included the £330m refurbishment of Citi Group’s iconic 42-storey tower at Canary Wharf finally got into contract in February, adding to the already sizeable pipeline of extensive refurbishments in the commercial sector.

Redevelopment of ITV’s former recording studio on London’s Southbank gained planning consent after a lengthy delay and Stanhope submitted revised plans for what will become the City of London’s tallest tower – 1 Undershaft – in January.

Barbour ABI consultant economist, Kelly Forrest commented:

“Generally, commercial project viability remains tight, but progress on these mega projects is nevertheless great news for the industry. Along with infrastructure, these sectors are providing an antidote to continued malaise in residential construction, which is still being weighed on by higher mortgage rates and weak consumer confidence.”

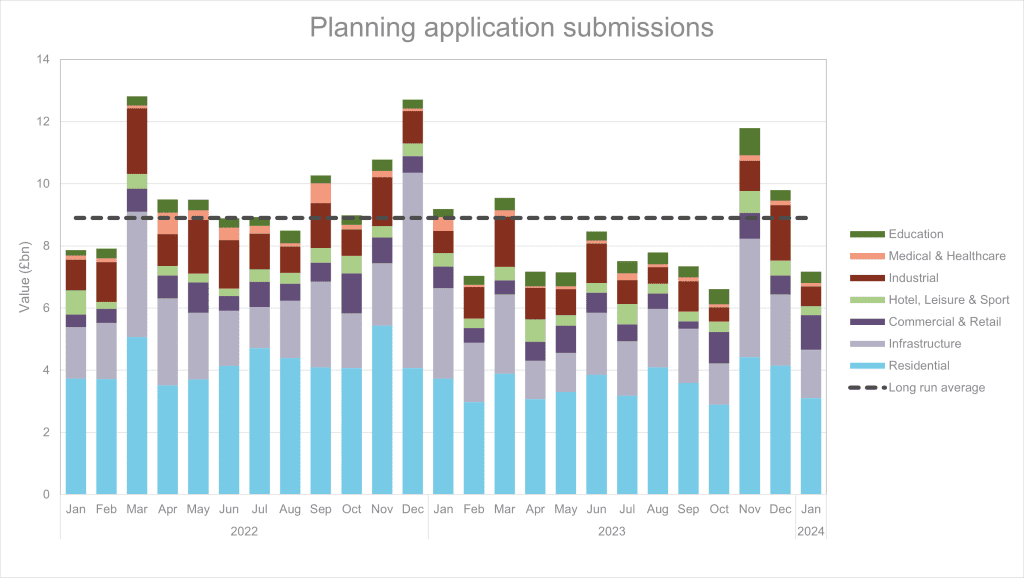

First look at planning applications

March provided a first look at planning applications in 2024. At £7.1bn in January, applications were 22% lower than a year ago with residential, Industrial and infrastructure all seeing sharp drop offs.

Forrest continued: “Notably, we are seeing clear divergence emerging between spending and new planning applications. Decision makers are eager to get existing and approved projects off the ground, but they don’t yet have the confidence to look ahead to new work. Viability is a big factor constraining developers’ appetite to present schemes to planners, but this should improve when financing costs start to reduce.”

Building, Design & Construction Magazine | The Choice of Industry Professionals