High-End Retail, Supermarkets and Mixed-Use Schemes Among the Modest Activity

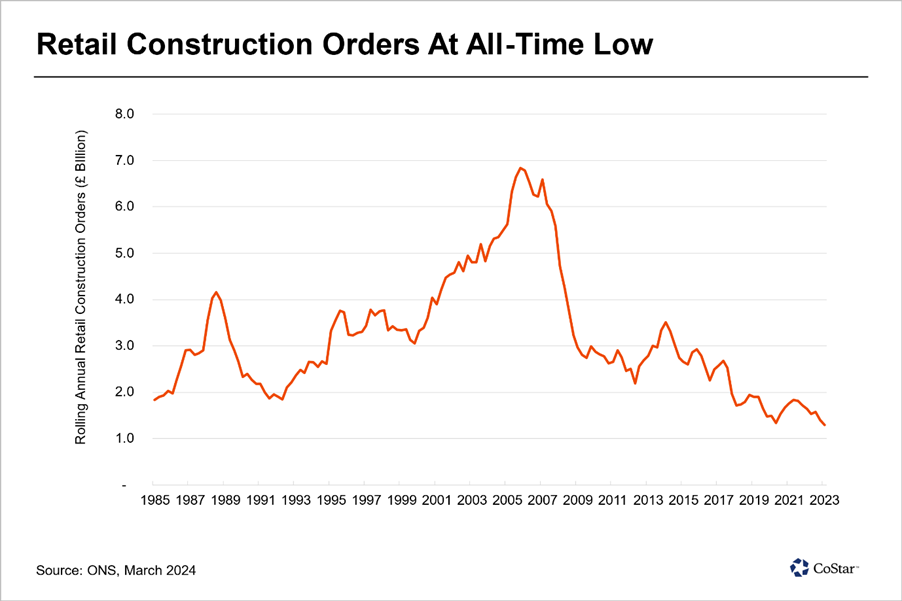

Retail construction orders fell to an all-time low during the final quarter of 2023, according to data from the Office for National Statistics.

Construction orders, a proxy for development activity, totalled £1.3 billion in the fourth quarter of last year on a rolling annual basis. The figure is the lowest since the data series began in 1985 and compares to an average of £3.2 billion since then and a high of £6.8 billion in 2006 – heady days when shopping centres Westfield, London and Liverpool One were being built.

The ONS statistics are supported by CoStar’s data on new construction starts, which were also at their lowest on record in 2023 at 3.15 million square feet – a gradual slowdown over the past ten years from 14.4 million in 2014.

This comes in the wake of the structural changes in the retail sector and development viability issues that are affecting all sectors – high finance and build costs, rising yields and subdued rental growth.

Deliveries are also slowing sharply and with the recent trend of converting shopping centres and department stores to other uses, net deliveries have also reached an all-time low.

Within the slowdown there are some modest outperforming segments that continue to see activity across the country. High-end retail schemes are among the most prominent, such as designer outlet villages at Scotch Corner and Tewkesbury, and large auto dealerships, including Porsche in Newport.

Mixed-use projects, where retail forms part of large new residential schemes, have increased in prominence in recent years, and there are several underway including Lewisham Gateway and Green Haus in Salford.

With retail park availability at an all-time low, a handful of schemes are among the key projects being built as well as several supermarkets – Aldi, Lidl and Tesco being the most active.

Despite the slowdown in construction, net deliveries are still expected to outpace net demand this year, putting further pressure on the vacancy rate. But the slowdown in construction orders means fewer completions can be expected after that. Coupled with the trend of owners converting retail to other uses, the vacancy rate should then begin to stabilise.

Building, Design & Construction Magazine | The Choice of Industry Professionals