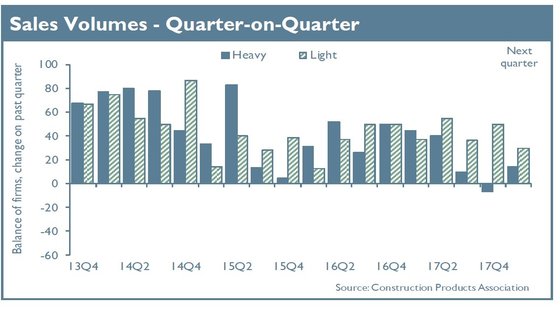

Sales of construction & building products slowed in the fourth quarter of 2017 and a further slowdown is expected in 2018.

The latest state of trade survey from the Construction Products Association (CPA) indicates that the UK’s £56.5bn construction product manufacturing industry is losing its pace.

The survey results showed that more heavy side building products manufacturers, such as steel, bricks, timber and concrete, reported a decrease in product sales in the fourth quarter of 2017 than an increase. The net balance was -6%, compared to a 10% balance reporting a rise in Q3. This was the first negative balance since the first quarter of 2013. In contrast, sales on the light side, which includes non-structural and finishing products such as insulation, boilers, glass and lighting, were still reported higher by half of manufacturing firms. A net balance of 50% of light side firms reported a rise in sales in Q4 2017. Light side building products are generally used later in the construction process and therefore would expect to follow the pattern of the heavy materials side some months later.

While manufacturers generally expect a modest pickup in sales in the first quarter of 2018, the survey showed a weakness in sales expectations extending across the next 12 months, for both heavy side and light side firms. No heavy side firms and only 10% of those on the light side expect to see an increase in product sales for 2018 as a whole.

CPA senior economist Rebecca Larkin said: “The survey echoes other industry data that has shown the prolonged period of growth in construction activity since 2013 started to lose pace in the closing months of 2017. Of note are the signals of a leaner 2018 with heavy side expectations for sales growth at their lowest in five years, reflecting a backdrop of a slower economy, Brexit uncertainty and falling new orders in key sectors such as commercial offices.

“As well as weaker market conditions, it appears as though a further rise in costs will strengthen the headwinds facing industry. In Q4, 87% of heavy side firms and 91% of light side firms reported a rise in raw materials costs, whilst on the energy-intensive heavy side, fuel and energy costs were reported higher for 93% of firms. This illustrates the lagged pass-through of the 2016 Sterling depreciation and rising global commodity prices into input cost inflation that is still to filter down the construction supply chain. Three-quarters of product manufacturers expect inflationary pressures to linger into 2018.”