Polyurethane (PU) market size analysis pegs demand at USD 51.5 billion in 2015 and forecasts global industry revenue of over USD 77 billion by 2023.Polyurethane (PU) Market Size By Product, By Application, Industry Analysis Report, Regional Outlook, Biobased PU Application Potential, Price Trends, Competitive Market Share & Forecast, 2016 – 2023

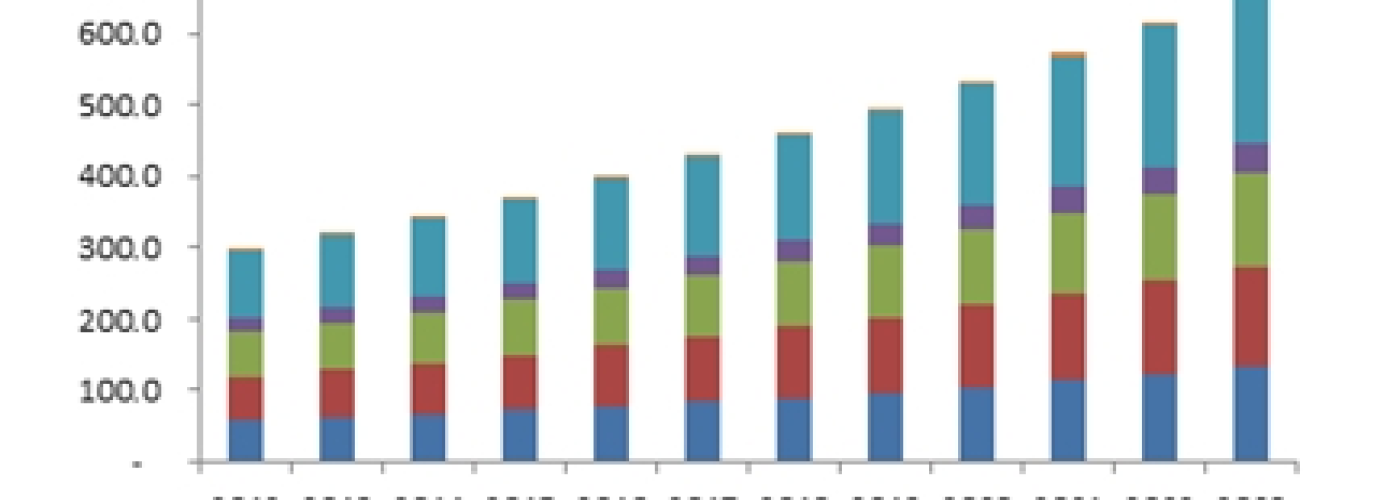

Polyurethane (PU) Market size is expected to reach USD 77.27 billion by 2023; according to the latest research report published by Global Market Insights, Inc.

Increasing energy conservation importance owing to rising costs and growing concerns regarding GHG emissions have been major factors driving global polyurethane market size. Government support to boost infrastructure in India, Brazil, and Mexico should promote PU market growth in construction application.

APAC, driven by India & China PU market size, dominated the regional industry demand and may generate over USD 33.5 billion revenue by 2023. Electronics & appliances application in APAC may observe highest gains over the forecast timeframe. Increasing importance for encapsulation of electronic components such as circuits and sensors is a major factor driving PU demand in electronics & appliances segment.

Request For Sample Report@

https://www.gminsights.com/request-sample/detail/387

Flexible polyurethane foam market size was dominant and industry expects gains at 4.7% CAGR by 2023. Increasing disposable income and changing lifestyle in BRICS nations has led to furniture industry growth and accounts to increasing flexible foam application in mattresses and automotive seating.

The automotive industry has been experiencing a significant change over the years and has observed a trend towards automobile weight reduction in order to improve fuel efficiency and curb emissions. Polyurethane, along with other plastics, is a vital part of the new trend as it is capable of providing substantial weight reduction.

Moreover, rubber components are increasingly being replaced by polymers in automobile applications which may provide boost to thermoplastic elastomers market size, including thermoplastic polyurethanes. Strong application outlook in automobiles such as seating, engine encapsulation, exterior panels, instrument panels, and cables & wires as an alternative to metals should drive PU market size.

Tight supply and correction in crude oil index may hamper availability of key raw materials, MDI & TDI. This factor may affect PU market price trend over the forecast timeframe and hamper manufacturer profitability index.

Inquire for Buying industry Analysis Report@

https://www.gminsights.com/inquiry-before-buying/387

Key insights from the report include:

- North America, with construction industry somewhat rebounding in the U.S., may observe below average growth rates. Rigid foam was majorly used product in the U.S. in 2015.

- U.S. polyurethane rigid foams market size is set to grow at 4.9% CAGR in revenue terms. They are used as insulation purpose to increase buildings energy efficiency and decrease thermal energy losses.

- Europe, driven by Germany, UK and Italy PU market share, is poised to exceed USD 21 billion revenue by 2023. Increasing thermal insulation application post EU legislations regarding energy efficiency of households may drive product demand in construction industry.

- Germany automotive application is set to grow at 3.7% CAGR by 2023. Presence of large scale automobile manufacturers may favor product demand. China footwear application may witness average gains at 5.4% CAGR and surpass USD 1.2 billion revenue by 2023.

- Growing demand for sports shoes and hiking boots with excellent grip may drive footwear application demand. Presence of footwear companies in the region along with increasing outsourced footwear production in countries such as Vietnam, Thailand, Bangladesh and Indonesia should drive PU market size.

- Global PU market share is highly consolidated and is dominated by MNCs having presence across the value chain. Covestro (formely Bayer MaterialScience), BASF, Huntsman Corporation and Dow are among notable industry players. Other participants include British Vita Unlimited, Foamex Innovations, Mitsui Chemicals, Nippon, Recticel and Woodbridge Foam Corp.