Glenigan’s December Review indicates a pick-up in momentum as economic certainty starts to return

- 31% increase in project-starts year on year

- 6% rise in main contract awards against 2023 levels

- 34% fall in detailed planning approvals against the previous year

Yesterday, Glenigan, one of the construction industry’s leading insight and intelligence experts, releases the December 2024 edition of its Construction Review.

This Review focuses on the three months to the end of November 2024, covering all major (>£100m) and underlying (<100m) projects, with all underlying figures seasonally adjusted.

It’s a report which provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals a unique insight into sector performance over the last 12 months.

The latest data paints a generally positive picture. Project-starts and main contract awards showed promising year-on-year growth, highlighting returning socioeconomic stability after an extended period of market uncertainty. However, tempering these activity boosts, detailed planning approvals suffered a significant decline, indicating that persistent cost pressures and dented industry confidence continue to hinder sector-wide revival.

Commenting on the December Review, Allan Wilen, Economic Director at Glenigan, says “There’s definitely work to be done and the latest figures show glimmers of recovery, with modest growth in project-starts and contract awards offering a degree of optimism. The Autumn Statement and some of the immediate actions taken by the Government to kickstart building in some verticals, particularly housebuilding will have helped. However, the sharp decline in detailed planning approvals highlights investors will be keeping their powder dry until more stability returns to the market, inspiring the confidence needed to turn on the development pipeline tap.

“In line with our Forecast predictions, H.1 2025 will unlikely see significant growth, however, H.2 will likely see a sudden spurt, following the Government’s Spring Spending Review and sector-specific strategic announcements. A sustained focus on public infrastructure, health, and housing projects will be critical to driving recovery in 2025 and beyond. The industry will be watching closely to see how these fiscal policies and investment commitments translate into on-the-ground activity.”

Underlying Sector Analysis – Residential

The Review period was relatively stable for residential construction, with project-starts falling 1% against the preceding three months to stand 6% lower than a year ago.

Private housing construction-starts were largely responsible for the decline, falling by 3% against the preceding three months and by 1% compared with last year.

However, this was balanced out by social housing-starts which increased 4% during the three months to November, despite coming in 20% down on the year before.

Underlying Sector Analysis – Non-Residential

Overall, non-residential performance rallied during the Index period, with starts up against both the previous quarter and last year.

Hotel & Leisure experienced a strong period, with starts increasing 37% against the preceding three months to stand 71% up on the same time a year ago.

Education project-starts also grew, rising 31% against the preceding three months and increasing 29% against the previous year.

Offices had a good period, with the value of underlying project-starts increasing 24% against the preceding three months and standing 2% up on a year ago.

Industrial project-start performance was dismal, suffering a 22% fall during the three months to November to stand 4% lower than a year ago. Community & amenity also fared poorly, with the value of project-starts falling back 14% against the preceding three months and 15% against the previous year.

Civils growth was poor, with starts decreasing 17% against the preceding three months and remaining flat against the year before. This was boosted slightly by infrastructure activity, with starts increasing by 1% against the preceding three months and by 36% on a year ago.

Utilities starts didn’t perform well, declining 41% against the preceding three months to stand 34% down against the previous year.

To find out more about Glenigan and its construction intelligence services click here.

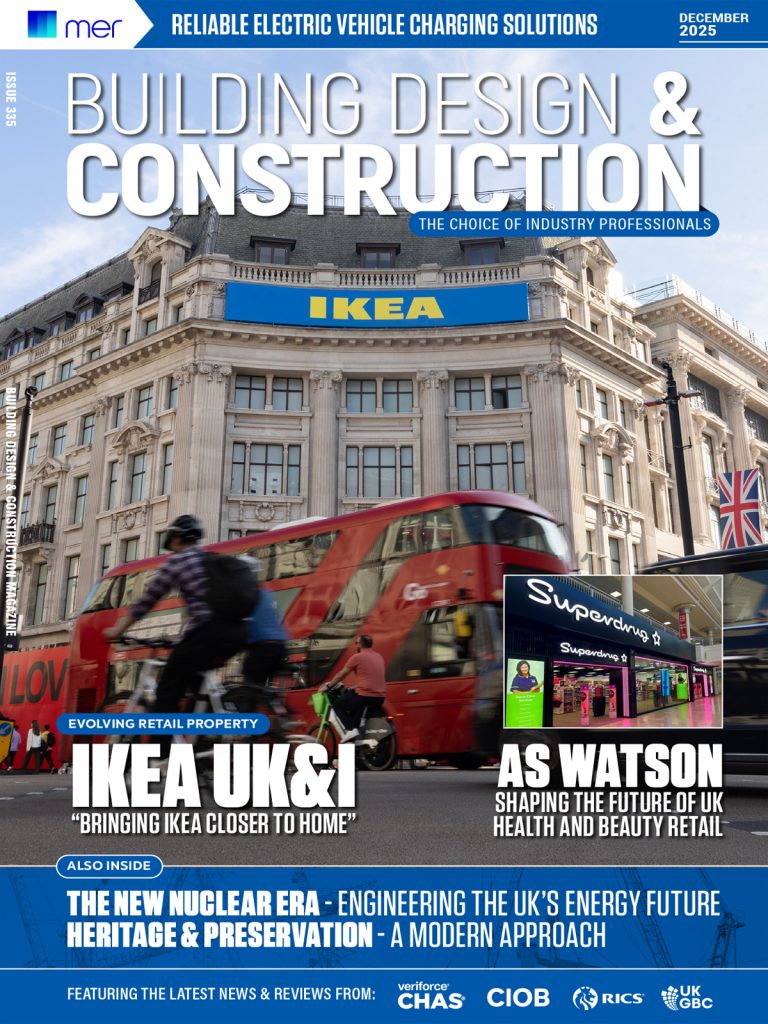

Building, Design & Construction Magazine | The Choice of Industry Professionals