- “Infrastructure has been carrying the rest of the industry on its’ back in 2024” – with big money contracts throughout the year

- But housing spend remains flat at 1% growth with new housing applications continuing to fall

- For the second year running housing applications were down by 6%, following a 15% fall in 2023.

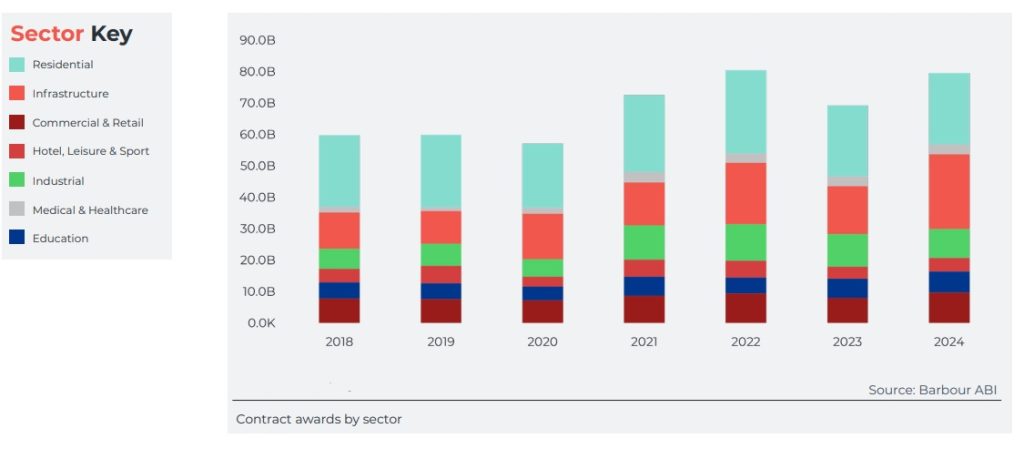

The UK construction industry saw a 15% increase in contract awards in 2024, reaching £79.5 billion, according to Barbour ABI. The biggest regional gain was seen in the East of England at 52% whilst the North East fell the most by 20%.

However, the surge in spending was driven largely by infrastructure projects, particularly green energy initiatives, which grew an impressive 56%. Barbour ABI analysts warned that this growth may be masking broader industry challenges. Housing activity remained stagnant, with just 1% growth, despite efforts by the Labour government to boost the sector, while industrial spending declined by 12%.

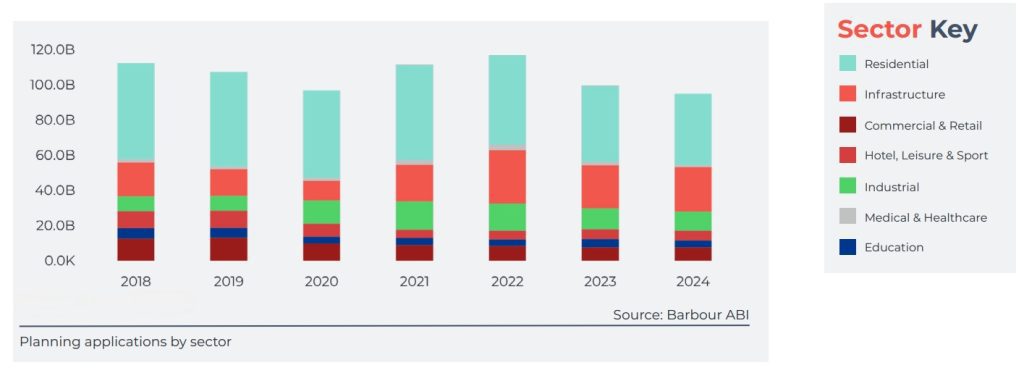

Planning approvals were also down 8%, dropping below £100bn for the first time since 2022 despite the new government’s efforts to kick start activity since the election in July.

Barbour ABI Head of Business and Client Analytics, Ed Griffiths commented, “Despite the headline growth, not all is as it seems. Infrastructure has been carrying the rest of the industry on its back in 2024. Without these projects, growth would be in the single digits.

“Rising costs, market uncertainty, and skilled labour shortages continue to plague the industry. Insolvencies, including the collapse of major contractors like ISG, have delayed key projects and created ripple effects across the sector. High interest rates have further discouraged investment, reducing demand for new homes and stalling large developments.”

Lack of underlying confidence in applications

Applications once again remained under £100bn and dipped a further 5% on an already poor performing 2023, reflecting how industry confidence remains stubbornly low. For the second year running housing applications were down by 6%, following a 15% fall in 2023.

“Labour’s planning reforms offer hope to housebuilders, but the industry is holding its breath to see if these changes will lead to a rise in applications for new builds in 2025,” added Griffiths. “In the meantime, we’re looking to emerging sectors like data centres, spurred by Keir Starmer’s recent AI investment announcements, to carry growth in the year ahead.”

Construction Industry Snapshot Report | Barbour ABI

Building, Design & Construction Magazine | The Choice of Industry Professionals