As the shock subsides the fallout of last week’s vote to leave the European Union is now under the spotlight. As bond yields slide to record lows, housebuilder’s share prices tumble and a number of development projects are reassessed, EG will be analysing what it means for the property industry.

As the shock subsides the fallout of last week’s vote to leave the European Union is now under the spotlight. As bond yields slide to record lows, housebuilder’s share prices tumble and a number of development projects are reassessed, EG will be analysing what it means for the property industry.

- What are the implications for the Northern Powerhouse, major infrastructure projects such as HS2, and the OJEU process?

- Who is most exposed to EU funding gaps?

- What does it mean for those looking to raise capital.

We will be updating with the answers here in the coming hours, days and weeks.

Follow @EstatesGazette

NEWS AND ANALYSIS

• Segro’s Sleath says ‘game has changed’ post Brexit vote

Segro chief executive David Sleath has warned the industry will have to be “extremely selective” about its policy priorities when lobbying a “distracted” government.

• Who’s lost out? Property directors’ share dealings under the microscope

Directors across the UK property industry rushed to buy shares in their own companies in the face of a market downturn after the Brexit vote.

• BoE warns of risks to UK financial stability

The Bank of England says the prospect of open-ended funds being forced to sell assets is a risk to the UK’s financial stability.

• Aviva is second property fund to suspend trading in wake of Brexit

Aviva Investors has suspended dealing on its £1.8bn property fund, becoming the second asset manager to take action in the wake of the Brexit vote.

• London resi sees Brexit boost

Residential instructions in London trebled in the week following the UK’s decision to leave the European Union, according to estate agents Douglas & Gordon.

• Is this the next credit crunch?

The UK real estate market faces the prospect of another credit crunch as lenders come to terms with an impending Brexit.

• William Newton: We must bridge the UK’s civic gap if we are to attract and retain money and talent

The UK has been plunged into a period of uncertainty. From the collapse of the pound, to the ruptured leadership of both the Tories and Labour, the past few days have felt like the greatest upheaval to our country I can remember.

• Robert Guest: Sorry, Gove and Brexiteers: The experts are right

“People in this country have had enough of experts,” said Michael Gove, one of the leaders of the campaign for Brexit.

• Bill Hughes: The EU result leaves Britain in the balance

For a lot of people – but clearly not the majority – last Friday was supposed to be just another day. Instead we were immediately faced with the prospect of prolonged uncertainty and, as reality set in, we began to ask ourselves question after question: how did it happen, what happens next, and will life ever be the same again?

• Brexit result panic prompts 40% share plunge

Housebuilder shares have been some of the securities hardest hit since last Thursday’s vote to leave the European Union.

• Alan Carter: Hunger for income has not disappeared

The outcome was unexpected, the reaction predictable and rational. The quoted sector rose by 8% in the week ahead of the referendum, and fell by 22% over the next two trading days.

• Listed propcos’ share prices crumble on Brexit

UK listed property companies suffered huge losses following the Brexit vote and have since only made partial recoveries.

• Overseas investors dominated property pre-referendum

Overseas investors piled into the UK property sector in the run-up to the EU referendum, according to data from Real Capital Analytics.

• Benson Elliot eyes UK for new fund

Fund manager Benson Elliot is preparing for a push on UK investments following last week’s EU referendum.

• ‘Never-endum’ groundhog day for EU-friendly Scotland

Investment volumes in Scotland could plummet again as a result of the turmoil around Brexit and the prospect of another independence referendum.

• German and French funds target dublin as investors recalibrate

The Irish investment market could benefit from the UK’s impending withdrawal from the European Union.

• Up to 100,000 finance jobs could leave UK

The City of London faces a post-Brexit exodus of international occupiers as they review the Square Mile’s credentials against those of other EU cities.

• End of EU cash forces search for alternatives

The EU has ploughed €43bn (£35.4bn) of long-term investment into the UK over the past eight years. Funding recipients have included regeneration schemes, social housing, university investment, skills and infrastructure, many in areas that voted to leave the EU.

• Spec schemes reviewed as uncertainty reigns

EU referendum: The UK’s vote to leave the EU has called into question the future of millions of square feet of development as the industry pauses in its decision-making amid economic uncertainty.

• UK property values forecast to fall by 5% next year

UK commercial property values could fall by an average of 4.9% next year and by up to 14.5% in the London office market, according to post-referendum forecasts from Real Estate Strategies.

• EU vote leaves funds fighting to halt redemptions

UK property funds are in a state of flux as they struggle to determine fair valuations following the UK’s decision to leave the European Union.

• C&W research says Scottish investment could plummet

EU referendum: Investment volumes in Scotland could plummet again as a result of the turmoil around Brexit and the prospect of another independence referendum.

• Fears for Northern Powerhouse as focus shifts to Brexit deal

The Northern Powerhouse is at risk if the government shifts its priority to devolving powers from Brussels to Whitehall instead of driving growth in UK cities, the industry has warned.

• Murray promises ‘certainty’ for housing industry post-Brexit

London’s deputy mayor for housing, James Murray, has warned that Brexit will make it harder to fix the housing crisis, but pledged to do all he could to give the industry more certainty.

• The EU result leaves Britain in the balance

For a lot of people – but clearly not the majority – last Friday was supposed to be just another day. Instead we were immediately faced with the prospect of prolonged uncertainty and, as reality set in, we began to ask ourselves question after question: how did it happen, what happens next, and will life ever be the same again?

• Residential analysis: an international sliver of hope for PCL

The devaluation of sterling accompanying the referendum could see a glut of prime London investment, but will it be enough to increase prices?

• Housing market ready to tumble

House prices are set to fall in the coming months due to the incredible economic uncertainty created by the EU referendum, though for many commentators it is too early to predict by how much.

• Alex Jeffrey: Amid the short-term volatility, good deals await savvy players

The UK has voted to leave the European Union, so now is the time to look to the future with a cool head. Much has been written about “why” and “what if”, but now we need to focus on “what next?”

• EG Question Time: London to retain competitive edge

Industry grandees last night rejected fears that London post-Brexit had lost its competitive edge in the global cities race to attract capital.

• McCarthy & Stone sees ‘uncertainty’

Retirement home specialist McCarthy & Stone has issued a market statement warning about the effect of Brexit on its order book completions.

• EU referendum leads to exciting investment opportunities

UK property has “exciting opportunities” in the wake of last week’s EU referendum, according to Benson Elliot.

• What does Brexit mean for the future of listed property companies?

The UK’s listed property companies have taken a beating since the markets opened on Friday morning after the country’s decision to leave the European Union.

• The firms who piled into property pre-Brexit

Overseas investors piled into the UK property sector in the run-up to the EU referendum, according to data from Real Capital Analytics.

• Analysis: building towards net zero

Last December, at the UN Climate Change conference in Paris, more than a dozen companies from across the built environment pledged to help drive delivery of “nearly zero energy buildings” by 2020.

• Housebuilder shares rally

Housebuilder shares have rallied on Tuesday morning as market turmoil following the EU referendum enters its third day.

• Firms witness EU ‘shock factor’

Auctioneers are reporting a lull and sense of disbelief after Britain’s vote to leave the European Union.

• UK investors pull out of property funds

UK retail investors are pulling out of property and UK equity funds and switching into global and Japanese equities, according to an analysis by rplan.co.uk.

• A sustainable future?

The country has spoken and, once Article 50 of the Lisbon Treaty has been triggered, two years or more of negotiations now lie ahead to come up with a roadmap for leaving the EU.

• Redrow: Brexit impact too early to tell

Redrow has said that it is too early to tell whether the Brexit will have any effect on sales.

• Housebuilders take stock market hit following Brexit

Trading on all four of the FTSE 100-listed housebuilders came to a temporary halt this morning as another day of losses shook the industry.

• ‘Limited’ Brexit impact on digs

Empiric Student Property predicts a “limited” Brexit impact on the UK student housing sector.

• Osborne: UK economy ‘fundamentally strong’

Chancellor George Osborne has said the UK economy is “fundamentally strong” but warned of continued “volatility” in financial markets.

• Interest rates ‘to fall’

The UK is facing the prospect of even lower interest rates, which would result in cheaper costs for real estate buyers.

• Foxtons shares drop 18%

Foxtons’ share price dropped by 18% in the first few minutes of trading this morning after it issued a profit warning.

Markets down but the sell-off is mostly modest and orderly. Spare a thought for Foxtons estate-agents though… pic.twitter.com/OZDJ7HuwAP

— Joel Hills (@ITVJoel) June 27, 2016

Back to top

PROPERTY SECTOR REACTION

• 5.03pm Argent’s Partridge – no mass exodus of tech occupiers

Argent’s David Partridge has said he does not foresee an exodus of tech occupiers from the UK as a result of the EU referendum result.

• 4.58pm The implications of Brexit for the property sector

It has been a momentous day with Brexit results being revealed. Estates Gazette journalists have spoken to some of the industry’s key figures about the implications for our sector.

• 3.39pm Property prices could be hit by rating downgrades

The prime and London property markets could be left reeling from a downgrade by the major ratings agencies.

• 3.35pm Brexit blues: the experts were right

“People in this country have had enough of experts,” said Michael Gove, one of the leaders of the campaign for Brexit. He was right.

• 2.22pm Brexit: Prime property “will increase in value”

LCP says prime central London property is likely to increase in value after the UK’s decisions to leave the EU.

Sources at Morgan Stanley tell BBC it’s already begun process of moving 2,000 London based investment banking staff to Dublin or Frankfurt

— Ben Thompson (@BBCBenThompson) June 24, 2016

• 1.40pm: Data: Residential repercussions

When global calamities hit what is the effect on residential property?

• 1.34pm: Research: how does a recession affect the property market in London?

Find out how a recession affects the property market in the capital.

• 1.19pm: Pound devaluation is the UK’s “not so secret weapon”

Currency and stock market movements have been well short of some of the more extreme forecasts and the devaluation of the pound can be the UK’s secret weapon, according to risk management consultancy JC Rathbone.

• 1.02pm: What does leaving mean for the prime market?

The outlook for the London and prime residential markets is far from certain. Housebuilder share prices, particularly those with a London focus, are down by more than 20%, but many are predicting an influx of investment. They are positive about the Pound’s devaluation, which has made overpriced assets in London relatively cheap once again.

• 12.28pm: Caddick: “2008 all over again – what a mess”

Caddick Developments’ director Johnny Caddick has warned of “massive stagnation” in the property sector with the regions most badly affected.

• 12.27pm: Reaction: Cushman’s Wilson & Quidnet’s Tice

This is bad news for housing associations. Their credit ratings will also be considered “untenable” https://t.co/kQxEb9Zz4q

— Nick Duxbury (@nickduxbury) June 24, 2016

Let’s make sure we rescue our respect and tolerance for all of society from today. It is what it is – onwards.

— John Forrester (@JohnFCushWake) June 24, 2016

• 11:49: Scottish property industry calls for clear political future

The Scottish property industry requires the country to have a clear political future in order to prosper according to the head of the Scottish Property Federation.

•11:23: Time for caution urges SEGRO boss David Sleath

Responding to this morning’s volatility in the markets, where SEGRO’s share price was down 10%, David Sleath said that immediate volatility was unsurprising but his company was optimistic in the medium and long term.

• 11:23: We have been here before in 1992 and 2008. Indeed a sharply lower pound is the UK’s not-so-secret weapon, JC Rathbone

“The FX markets gyrated with every result and comment. At one point, a commentator announced that GBP/USD was 1.4000, when it had already bounced back to 1.4300 in the space of about a minute.

As the night wore on, sterling was steadily marked down and currently trades at 1.3720. Indeed the overnight movements are extraordinary but far short of some of the more extreme forecasts: GBP/USD down nearly 8%, GBP/EUR, at 1.2370, down 5.6%; five-year quarterly swap rates down 40 basis points at 0.56%; gold up 5% in dollar terms and over 12% in sterling terms on flight to safety.”

• 11:18: European markets seem to be in bigger turmoil than UK, one word on everyone’s lips: Contagion

World stock markets have been left reeling by the UK out vote. At the time of writing the FTSE All share was down 5.1%.

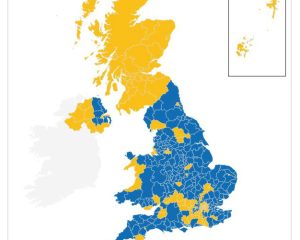

• 11:02: Brexit vote “shows London and regions disconnect”

The UK public’s decision to leave the European Union reflects the disconnect between London and the regions, says Jonathan Goldstein, chief executive of Cain Hoy

How the UK voted. Source: BBC

•10:47: We have funds allocated to maintain our position and secure investment in the UK says surprised and saddened, HB Reavis

“I am surprised and saddened that the UK has concluded that leaving the EU is best for the country. The short-to-medium term will be challenging as investors do not like uncertainty, but I believe the London commercial market will remain a good investment in the long-term.

“At HB Reavis, we have approached the likely repercussions of a Leave vote from a strategic point of view and therefore allocated funds to maintain our position and secure our investment in the UK.

“We will continue to have a positive outlook on what lies ahead and will carry on with our ambition to grow our business in the UK.” Tomas Jurdak, UK chief executive HB Reavis.

This @FT graphic pretty striking. #Brexit vote as much about metropolitan London v rest of UK as UK v Europe pic.twitter.com/FtHWCvqceo

— olivershah (@olivershah) June 24, 2016

• 10:35: London portfolio will afford us some protection from Brexit, Jonathan Goldstein, Cain Hoy

“The UK public’s decision to leave the European Union reflects the disconnect between London and the regions. “We’ve deliberately and specifically been very London centric with our investments. “I think that come the calm after the storm London will be still seen to be the centre of European financial world and it has all the advantages that we have talked of for many years like time zones and language and legal system so I remain confident in London’s future, not withstanding, as Michael Gove himself has said, bumps in the road until we get there,” Jonathan Goldstein, chief executive of Cain Hoy.

• 10:31: Disappointing for UK retail and those encouraging European retailers into UK, BCSC

“This result will clearly be disappointing for many people in the UK retail and retail property sector, leading to further uncertainty in the market and in the minds of consumers – when what we should be doing is encouraging more international and European investors and retailers into the UK. “But change won’t happen overnight. The prospects for the wider economy and consumer confidence will now depend in part on negotiations over the UK’s new status. “We hope those negotiations happen quickly and effectively to create the right conditions for the retail sector to continue to deliver employment opportunities and invest in UK towns and cities, contributing to local economies and communities.” Edward Cooke, acting chief executive at BCSC

Croydon Council to seek assurances from Westfield and Hammerson after Brexit vote https://t.co/kjZqcc2SNm pic.twitter.com/Zpqauf9D0y

— Croydon Advertiser (@CroydonAd) June 24, 2016

• 10:27: Scotland agents issue cautious comment on the future post Brexit

“It is difficult therefore to see how this vote for the UK to leave the European Union and the uncertainties this will create will turn the fortunes of the Scottish property market around for the remainder of 2016.

“However, now the vote is out the way some projects will move forward. The best we can hope for is that the fall in value for Sterling against the Euro and the dollar will attract more inward investment and that Scottish entrepreneurialism will come to the fore and look for ways to take advantage of the opportunities and challenges ahead.”David Davidson, chairman of Cushman & Wakefield in Scotland.

• 10:19: Logistics market reliant on pan-European trade to slow dramatically in Q3 and Q4. Andrew Toy, regional research team leader, EGi

“This is a leap into the darkness making long distance predictions challenging. Somewhat inevitably the industrial and logistics market, so reliant on pan-European trade, will be hit hard with take-up predicted to slow dramatically in Q3 and likely into Q4 and beyond as the market comes to terms with what has happened. It could be well into 2017 before things show sign of recovery at which point our future international economic trade details become clearer.

“Having been the flagship sector in the UK in a burgeoning market of late, one thing we can be sure of is that the industrial sector is set for some particularly challenging and turbulent times ahead.

“Deals markets have slowed in recent months as buyers, letters and investors awaited the big day and that bottleneck of deals was expected to release during Q3 upon the outcome of the much-anticipated and heavily backed remain vote. From an industrial perspective, if we look at the number of deals and volume of sqft transacted nationwide in Q3 over the past few years we see a steady flow of between 30m-35m sq ft and approx. 2,500-3,000 deals (see below).”

Andrew Toy, EGi

•10:11: Diversified portfolio vital, Mahbod Nia, Northstar Realty Europe

“Ultimately, we believe the long term prospects for the UK and the rest of Europe are positive, but the UK market is likely to enter a period of uncertainty and illiquidity in the near term which could also create compelling investment opportunities.

“For investors, a diversified portfolio will be vital. Market disruption often results in a flight to quality and as such investors are likely to continue to be drawn to prime office assets in major European cities including London.” Mahbod Nia, Northstar Realty Europe

• 10:00: Britain is over its Stockholm syndrome, Pippa Malmgrem, a leading investor advisor and former economic advisor to George W Bush

The Brexit vote is “a wake-up call no anyone who is not privileged” according to a leading investor advisor who has dubbed it the start of a global anti-establishment movement.

• 09:53: Momentous day in politics, Nick Leslau, Prestbury

Leave supporter and chairman of Prestbury, Nick Leslau has said hailed a “momentous day” in politics. Leslau says that despite this morning’s turbulence that “UK real estate has throughout history been a fundamental part of our investment landscape and that simply won’t change”.

• 09:44: Brexit makes no difference, Andrew Perloff, Panther Securities

Britain leaving the European Union “doesn’t’ make much difference” to the UK property market according to Andrew Perloff, chief executive of Panther Securities and long-time UKIP supporter.

Perloff said that he there was “inevitably going to be considerable volatility because so many people had assumed a remain win was likely” following the FTSE 250 opening more than 11% down and the pound at record lows against the dollar.

• 09:17: Bank of England: We are well prepared

“British Bank of England governor Mark Carney has issued a statement saying there is up to £250bn of additional funds to support the financial markets.

“But we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning,” he said.

“The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward. These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years.”

London will continue to be the successful city that it is today – via @standardnews #LondonIsOpen https://t.co/VyUeXlpSLN

— Sadiq Khan (@SadiqKhan) June 24, 2016

• 09:11: British Land issue statement as property shares are smashed

“British Land is a resilient business positioned for a range of economic conditions, including the uncertainty that is likely to be created by the UK’s decision to leave the EU: our portfolio is modern and nearly fully let to quality occupiers on long leases; our finances are strong with moderate LTV, low costs and long dated financing from a wide range of sources; our current development commitments are modest and we have optionality in our future development pipeline.” British Land

• 09:05 Property law not heavily influenced by EU legislation. Lawyers react to Brexit

“Britain’s decision to leave the EU is monumental. However, property law is not heavily influenced by EU legislation and, therefore, Brexit will be a market issue, rather than a strictly legal one,”Rob Thompson, head of real estate London at Irwin Mitchell.

• 08:56:Considerable strain on real estate markets in next 12-24months, long term: neutral, Alan Tripp, LaSalle Investment Management

“Earlier today, we learned the result of the UK referendum, with the British electorate voting to leave the European Union. This is likely to be followed by a period of uncertainty in the financial community. “Whilst we view the long term impact of Brexit as being broadly neutral we expect markets to overreact in the short term. Early capital market signals seem to indicate that this may well be the case and real estate performance objectives may now come under considerable strain in the next 12 to 24 months.” Alan Tripp, Head of UK, LaSalle Investment Management

• 08:50: We have £250bn to spend to support the Sterling, Mark Carney, governor of the Bank of England

• 08:45: Housebuilders share prices as of 0845 GMT via Google Finance

• 08:45 Property shares smashed

“Property shares were smashed in early trading this morning following the leave result of the European Union referendum. The FTSE 250 saw an initial 11.4% drop this and after falls of more than 30% were experienced at the outset amongst the largest companies in the commercial property sector but there has since been a relative recovery, more closely in line with the market.”

• 08:35: Could this solve the housing crisis overnight? – Alex Peace, EG‘s residential reporter

“Solving the housing crisis overnight Migration: 1.2m British live in the EU, 3.3m EU citizens live in the UK. If we swap, that’s 2.1m spare rooms – more than enough to address the shortage of 1m homes in the UK.”

Outside No.10 where David Cameron has just resigned @EstatesGazette @RolandTevion pic.twitter.com/GzEEDYQsrx

— Louisa Clarence (@LouisaClarence) June 24, 2016

• 08:35: 10m sq ft of finance sector in Central London subject to lease break/expiry by 2021, Graham Shone, data analyst EGi

“The vote to leave the EU may well prove to be a sticking point for financial firms occupying large offices in the UK. Details of new trade agreements will of course be critical to give them the full picture before making location-based decisions – and it might still be a little while before we know what exactly those are.

“Our figures indicate that just shy of 10 million SQ FT of floorspace occupied by the finance sector in Central London is the subject of either a lease break or a lease expiry before 2021 – over 20% of the total financial footprint in the capital [AS OF Q1 2016]. Over the medium term post-Brexit, the worry for London’s office market would be that a significant proportion of those occupiers look to undertake partial or wholesale moves – particularly those with a significant client base in the Eurozone.” Graham Shone, data analyst EGi

• 08:28 David Cameron announces he will step down by the time of the Tory party conference

• 08:23 This is an anti-establishment vote..British property could be more attractive, Pippa Malmgrem, former economic adviser to George W Bush

“I’ve been pro-Brexit for 18 months or so and called for a landslide in the voting results. This is an anti-establishment vote and that’s why “The Establishment” doesn’t “get it”. The fall in Sterling will make British properties even more attractive.

Far from weakening the economy, lower Sterling will boost British exports and British equities. Britain can mess this up by closing off immigration or by raising taxes, but there is no need for either.” Pippa Malmgrem, former economic adviser to George W Bush

• 08:20 Business need to ensure they are set up to navigate the immediate risks, David Sproul, chief executive of Deloitte UK

“While the UK has opted for a future outside the EU, Britain remains a competitive, innovative and highly-skilled economy and an attractive place for business.

“However, as indicated by today’s market volatility we are likely to see a period of uncertainty. Businesses need to ensure they are set up to navigate the immediate risks and impacts of an exit, and have the processes and people in place to manage a period of upheaval.

“From the result of the referendum is that the value of the pound will inevitably fall in the near-term, as will the stock market.” said David Sproul, chief executive of Deloitte UK.

• 08:17 London stock markets open. Property share prices show huge drops

• 08:17 London stock markets open. Segro share price, Source: Google Finance

• 08:10 London stock markets open. Barratt share price, Source: Google Finance

• 08:15 London stock markets open. British Land share price, Source: Google Finance

• 08:10 London stock markets open. Land Sec share price, Source: Google Finance

• 08:10 Chances of technical recession high, James Roberts Knight Frank

“One of the first outcomes from the result of the referendum is that the value of the pound will inevitably fall in the near-term, as will the stock market. “The chances of a technical recession, as business investment is curtailed, is high, and exporters and financial services firms will be in the forefront of the downturn.” James Roberts, of Knight Frank

• 08:08 German residential to benefit JP Morgan Cazenove:

“On the defensive side, German residential will likely be well bid, led by Vonovia due to liquidity, and dividend/income plays such as LondonMetric, SEGRO should be supported. On the retail plays, dividend yields and continental exposure of intu and Hammerson must be balanced against concerns over the near term economic outlook.”

• 08:03 Property will test the February lows today JP Morgan Cazenove:

“We see most downside risk in London office facing stocks, Derwent London, Great Portland, Workspace and Helical Bar with Land Securities and British Land used by larger investors to express the vote outcome due to liquidity.”

• 07:55 Mike Sales: Fund managers begin chaotic day

“Fund managers in the UK have begun a chaotic day ahead, updating investors and starting an adaption to life outside the European Union. Mike Sales, global co-head of TH Real Estate, the $26bn property manager, said that he was “slightly shocked” but that the company had been preparing for the eventuality and it had “identified work streams or areas such as valuation, product regulation, tax and operations among other areas to work through the various issues and consequences”.

• 07:45 Mike Ingall: Regional cities could benefit

“Regional cities could benefit if London’s position is affected on the global stage. “I think the key will actually probably be what happens in London and the speed at which London remains affected in its position in the world,” he said.markets are yet to open but early forecasts suggest the FTSE will open almost 8% lower whilst the pound has dropped by more than 10% to a 31-year low.” Mike Ingall, Allied London.

• 07:36 Hometrack: London housing volumes could drop by 20%

“The decision to leave the EU will be most keenly felt in the London housing market which is fully valued and already facing headwinds. History shows that external shocks can reduce sales volumes by as much as 20% with sales volumes already down over the last year.

The additional downside risks are how much of an economic downturn we see and whether mortgage rates end up rising which could turn a major slowdown in activity into something more severe” Richard Donnell, Hometrack

• 07:30 JLL: Housing transactions to drop 10-15%

“We expect an immediate slowdown in housing market transactions, in the order of 10%-15%, resulting in downward pressure on prices for at least a couple of years. We anticipate current activity levels will return but this is unlikely before late in 2018.” Adam Challlis, JLL

• 07:15 Time for Plan B says EG editor Damian Wild

“The result of the referendum was not the one wanted by the majority of those in this industry I have spoken to in recent weeks. But the decision is already history; the most important thing now is move on quickly. After all the turnout was reassuringly high, the result more emphatic than most expected. It’s too important for Remainers to mourn, to blame, to wallow”

• 06:00 Property reeling after Brexit

“Stock markets are yet to open but early forecasts suggest the FTSE will open almost 8% lower whilst the pound has dropped by more than 10% to a 31-year low.”

• Investors to debate at post-referendum Question Time

Following the UK’s decision to leave the EU, international investors prepare to debate questions from the industry on how the vote has affected their investment decisions.

Graphic courtesy of Square One Law. Click on the image to visit the site

Back to top

FROM THE ARCHIVES:

Brexit v Bremain

We asked you nearly 2 month ago. On the eve of the #EUref have you changed your mind? What would benefit property?

— Estates Gazette (@EstatesGazette) June 22, 2016

Estates Gazette view: A vote to leave would damage property industry

If anyone had sought to devise a mechanism for screwing up investment, dividing the country and make us think even less of our politicians, they couldn’t have done better than this referendum.

Property’s Brexiteers make their case

Nick Leslau, chairman of Prestbury Investments, nailed his colours to the leave mast in a column for Estates Gazette at the beginning of June calling for the volume on Brexit to be turned down.

Stay or go? The economists’ views

Savvas Savouri and Neil Blake put forward their cases in the run-up to the EU Referendum

Survey: the effects of a leave vote

Bilfinger GVA has surveyed its staff for their views on what would happen if the UK votes to leave the EU tomorrow

Where do propcos stand on Brexit?

The UK’s largest listed property companies as well as a host of leading names from non-listed companies support a Remain vote. EG here offers a collection of their comments

20 years on: all change after Brexit

As the UK considers its own future in or out of the European Union, proptech blogger and housing market commentator Rayhan Rafiq-Omar takes a look what real estate, driven by technology, might look like two decades on from a Brexit

Work on City’s tallest tower pauses for EU referendum

Building work on what will be the City of London’s tallest has paused because of uncertainty around tomorrow’s UK referendum on remaining or leaving the EU.

Blackstone and Brookfield join Remain camp

Senior executives of the two largest property owners in the world have come out in support of the UK remaining in the EU.

EU referendum: what the agents say

With the EU referendum just two days away the UK’s top agency firms have shared their views on how they hope the vote will go and how they are handling the disruption.

Property squarely against Brexit

Not a single central London commercial property market professional believes a pro-Brexit vote would be positive for the sector, according to RICS. More…

Nick Leslau: Calm down and slip the noose of Brussels

It’s time to turn down the volume on the Brexit debate. There is way too much noise and emotion without much credible substance. More…

Leslau clarifies view on Europe

The chairman of Prestbury Investments has sought to further clarify his advocacy on Britain leaving the European Union. More…

JLL’s Grainger backs Remain campaign

JLL’s EMEA chief executive, Guy Grainger, gave an impassioned plea for voters to stay in the EU at the forthcoming referendum. More…

Vicky Pryce: Brexit will bring investment uncertainty

The economist Vicky Pryce has said a Brexit will increase the “uncertainty premium” with foreign investors. More…

Airport expansion problems pose threat to London’s credibility

London’s failure to prioritise its airport capacity problems is damaging its reputation among international investors, experts said at the London Real Estate Forum. More…

Alex Jeffrey: Portfolio resilience is key

We are firmly in support of the UK remaining in the EU as we believe it is in the best interests of our clients, our employees and our business. However, the outcome is uncertain. More…

Offices most at risk from Brexit

The office sector is the most likely to be affected by a vote to leave the European Union, according to property professionals. More…

Back to top