Residential planning and approvals provided little hope for a short-term recovery of the market in Barbour ABI’s latest market figures, whilst contract award values continue to highlight market volatility.

Planning applications and approvals across the construction industry remained subdued in May after a turn for the worst in April which saw contract awards fall by a third and planning approvals at their lowest since June 2022.

Approvals are at just £6.1bn, and applications have fallen to £7.4bn, with similar trends across both, according to the latest figures from Barbour ABI.

The residential sector looks weak, with a 30% bump in April applications falling back to just £3.2bn in May and with limited recovery in approvals. This suggests there is little hope for those looking for a rally in tumbling house-building numbers in the short term.

Infrastructure also appears to have fallen over the last few months, with overall planning activity decreasing by 15-25% compared to last year. Infrastructure applications fell by 50% in May to £1.3bn compared to April, the weakest monthly value since Sept 2021.

Contract Awards

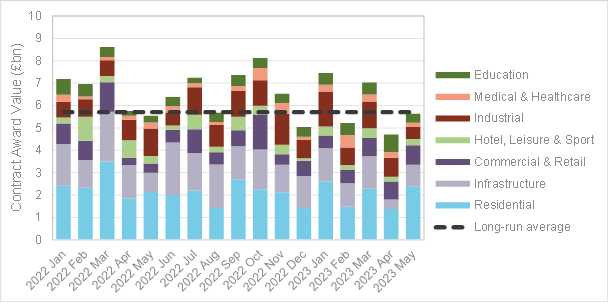

Meanwhile, contract awards provide a more complex picture, recovering by 20% compared to April with £5.6bn, in line with the long-run average – but well down from the £6.6bn per month seen over Q1 and 2022. Surprisingly Residential contract awards saw a sharp increase after a 30% fall in April.

Barbour ABI Chief Economist Tom Hall explained, “Across construction sectors, May was a strange month for contract awards as some sectors bucked recent negative trends. Residential and commercial sectors saw a welcome bounce while others suffered, highlighting the continuing see-sawing and uncertainty we have seen in recent months.

Meanwhile, the industrial sector suffered a disappointing 37% fall. May’s £500m was the lowest level since last June. The infrastructure sector also seems to be on a new lower path, with the second month in a row below £1bn: the last time this happened was in 2021.”

Find out more at Barbour-abi.com.