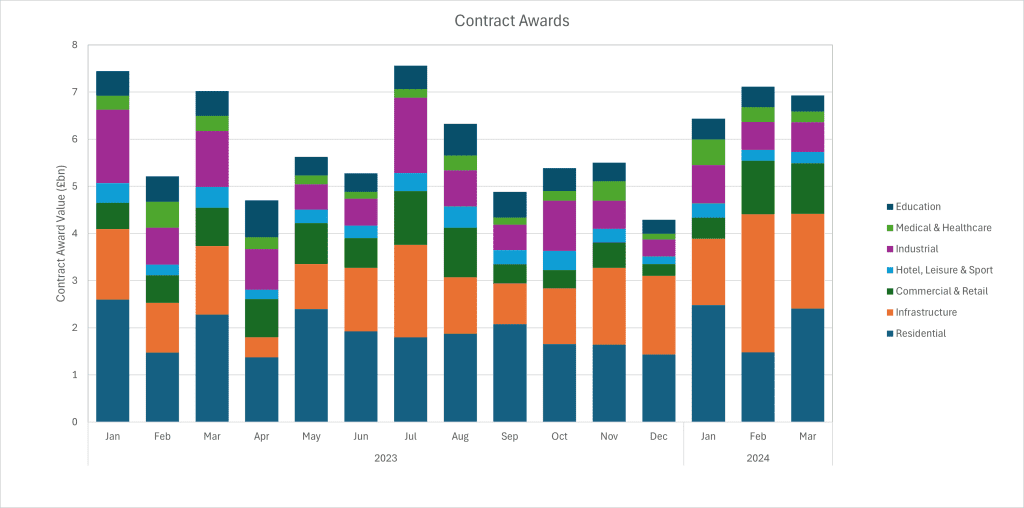

- Awards see slight fall on the previous month but the residential sector bounces back from poor February.

- A continued positive trend in contract awards in Q1 suggests the sector is looking to emerge from doldrums of 2023.

- Lack of new applications suggests the crossroads have not yet been passed.

Construction contract rewards remained stable in March following a quarter which had showed a significant increase since the beginning of the year. The value of new contracts was 3% down in February and 1% down on the previous year but remained significantly above the last quarter of 2023, according to analysis from Barbour ABI.

Notably, residential contracts were up 60% in February, returning to heights seen in January and were up 62% over the first quarter of the year. Meanwhile, infrastructure fell back to more normal levels following a stellar February but remained 38% up on the same month last year.

A new student accommodation facility on Medlock Steet, Manchester will cost £200 million, whilst a new National Grid convertor station at Eastern Green will be built at a cost of £700 million. A new prison at HMP Gartree was also awarded at a cost of £300million. Wates will carry out the work which will commence July 2024.

Barbour ABI head of business and client analytics, Ed Griffiths commented:

“When looking across the first quarter of 2024 it has become clear that both the infrastructure and residential sectors have had strong starts to the year as businesses attempt to get projects off the ground, which is a positive signal the construction sector is attempting to emerge from the doldrums of last year.

“Interestingly in March, we saw Residential and Infrastructure swapping positions in terms of leading overall contract awards value with £2.4bn and £2bn respectively. Together they are pushing the industry awards upwards.”

Elsewhere Healthcare projects were subdued in March following two strong months and Economic conditions continue to stagnate the Hotel and Leisure Sector

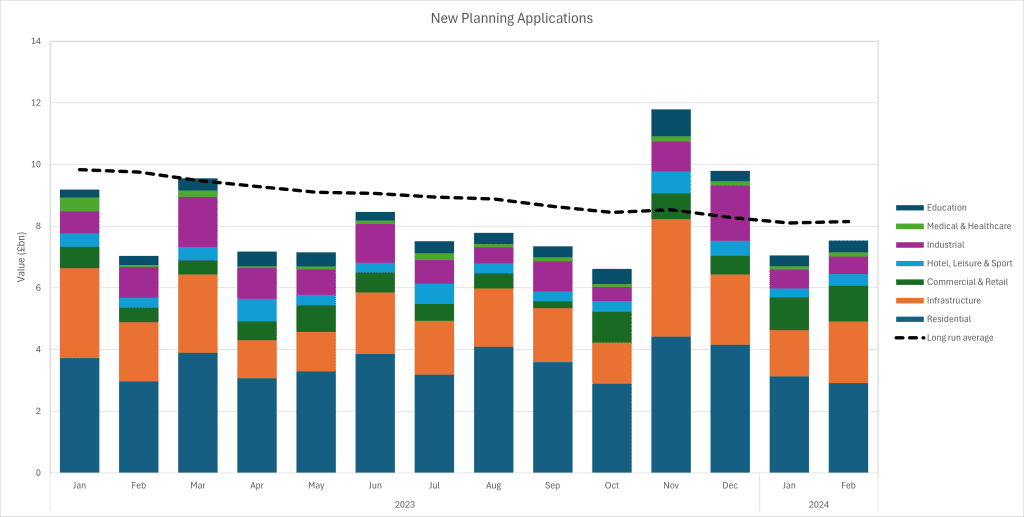

Applications continue to confound recovery.

Planning applications have improved in February after a weak start to the year in January but activity levels in most sectors remain low, highlighting that nervousness remains in the sector to commit to future projects ahead of potential rates cuts and upcoming elections.

Infrastructure has increased 33% since last month and remains strong against its long-term average. However, it has not returned to the highs of the end of last year. Residential applications fell once again from £3.1bn in January to £2.9bn in February.

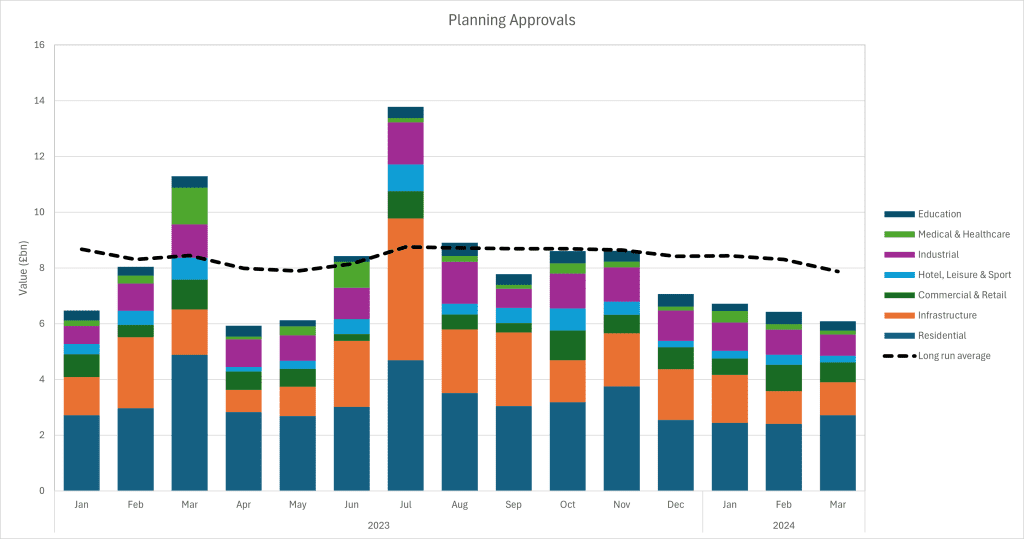

Griffithscontinued: “The enduring story of 2024 so far has been the contradiction between a rise in contracts awarded, sometimes even for projects which have not yet been fully approved, and the continued lack of confidence shown in both in new applications and approvals – which have been contracting since last November. The industry stands at a crossroads where financial and political decisions made at a national level could tip the balance in either direction.”

Find out more at https://barbour-abi.com/

Building, Design & Construction Magazine | The Choice of Industry Professionals