- Mixed picture for infrastructure sees positive performance in approvals but a 41% spending decrease.

- Residential has a strong month on spending and planning applications as Local authority work provides a lifeline to housebuilders.

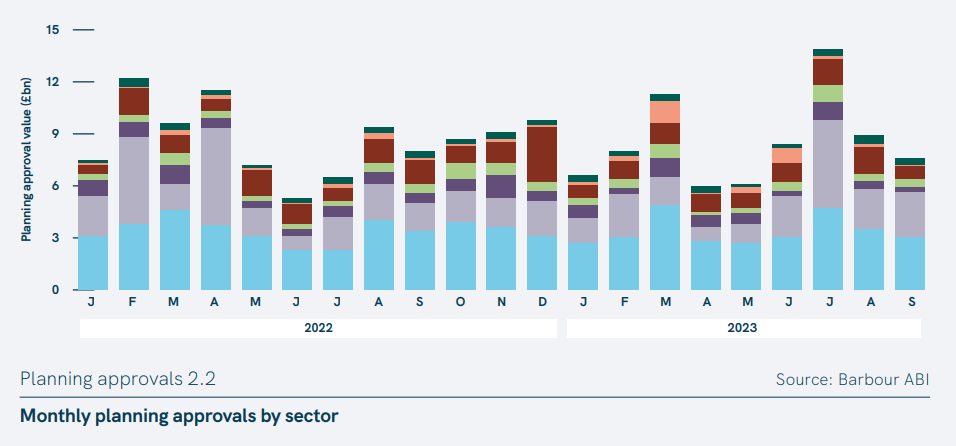

The UK construction industry continued to struggle with spending down 23% in September and planning approvals also down 13% according to the latest analysis by construction analysts Barbour ABI. Meanwhile, planning applications failed to break out of their recent holding pattern.

A mixed picture for Infrastructure

Infrastructure was a star performer in planning approvals, raising 16% in September and nearly 80% year on year to 3.3bn in Q3. However, it wasn’t all good news, with infrastructure spending falling 28% to less than £900m from August to September and remaining down 41% year-on-year. Energy remains a bright spot, but activity across other sub-sectors was subdued.

Barbour ABI Consultant Economist Kelly Forestcommented, “Infrastructure is currently painting an uncertain picture with policy changes around HS2 weighing heavily on the sector’s future. How fast funds are reallocated from HS2 phase 2 and to where will have a huge impact on construction businesses operating in the transport space.

Meanwhile, investment in green energy projects remains an important crutch for the industry and a key driver for infrastructure activity. We will have to hope that continues despite Rishi Sunak’s recent vacillating on green policy.”

Residential sees sunlight

There were some rare positive indicators for residential construction in the latest analysis. While awards were still down from this time last year, they jumped 11% from August due to a revival in activity by local authorities. There was also a mini-resurgence in the latest planning application figures, with a 20% climb in August to £4bn worth of applications.

“Any good news for beleaguered housebuilders is welcome as the sector continues to struggle, and September revealed some interesting trends,” said Forrest. “Local Authorities may provide an unexpected lifeline as they seek public-private partnerships to fulfil ever-urgent social housing needs. We have already seen housebuilders such as Vistry switching focus to social housing, and the latest figures show that activity is increasing in this area.

“That said, Approvals remain low, so it will be interesting to see how this pans out over the as we head into 2024.”

Quarterly trends

As Q3 came to a close, patterns also emerged in longer-term trends. Q3 awards were 11% higher than a year ago in all sectors and 20% higher than Q2. Approvals tailed off in September, but Q3 was strong overall, up by nearly 50% against Q2 and nearly 30% higher than Q3 2022.

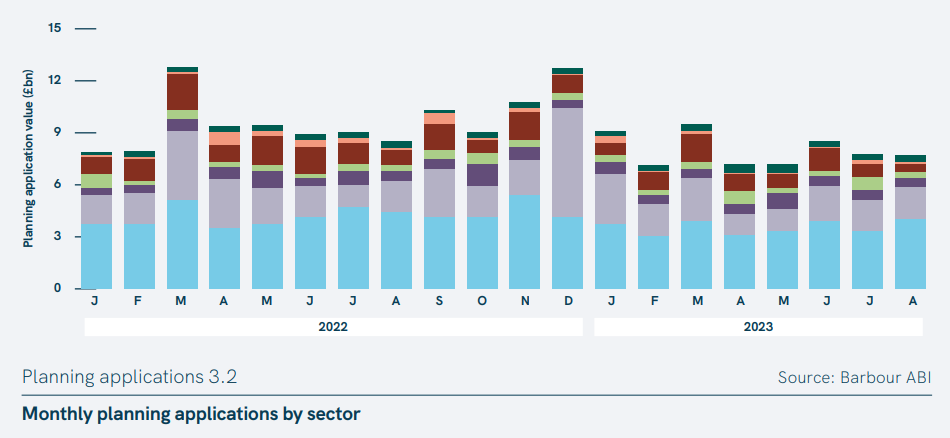

In terms of planning applications, there have been relatively consistent levels in recent months, painting an overall picture of stabilisation – if at a slightly lower level than in 2022.

Building, Design & Construction Magazine | The Choice of Industry Professionals