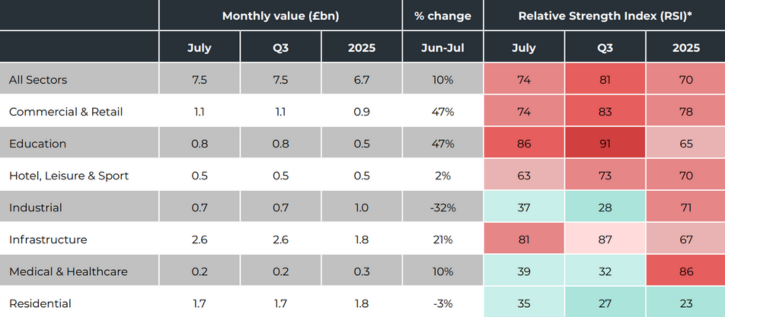

Construction contracts increased again in July with new work valued at £7.5 billion, according to analysis from Barbour ABI. The uptick places awards close to their highest level so far this year, marking a 10% rise on June and surpassing both the 2024 and 2025 monthly averages.

The positive figures are driven by a resurgence in infrastructure, education and commercial projects. Infrastructure rose by 21% to £2.6 billion, the highest since February, buoyed by headline schemes like the £400 million Thameside Energy Recovery Facility.

Commercial and retail projects climbed 47% to £1.1 billion, largely attributed to the Botanic Place mixed-use development in Cambridge.

Planning approval value also increased in July by 38% to £15bn with all sectors seeing a boost from the previous month. Notably, education recovered well after a poor June increasing 132%, helped by the approval of 14 projects over £10 million.

Planning applications, however, are down by 16% to £7.67 billion. This decline in early-stage proposals suggests a lack of confidence to future work which is reflected in the S&P Global UK Construction Purchasing Managers Index (PMI), which has now recorded seven consecutive months below the 50 ‘no change’ mark. While current projects are progressing, this softening in applications hints at potential challenges in the pipeline.

“The positive figures in contracts and approvals shows that the market today remains active and competitive, with work happening now and demand remaining strong in key sectors like infrastructure and education,” says Barbour ABI head of business and client analytics, Ed Griffiths.

“The concern is that with fewer planning proposals are coming forward, and with the PMI still signalling contraction, there’s a risk that the flow of new projects could slow in the months ahead. Winning work in the second half of the year may become tougher if confidence at the planning stage does not recover.”

Building, Design & Construction Magazine | The Choice of Industry Professionals