By Eve Pope, Technology Analyst at IDTechEx

In a world with a growing population and a rapidly expanding construction sector to match, how do we prevent building homes from damaging our climate? Concrete is the second most consumed material on Earth, but its key ingredient, cement, is responsible for 7% of global anthropogenic CO2 emissions. The answer could come from thin air – CO2-derived building materials.

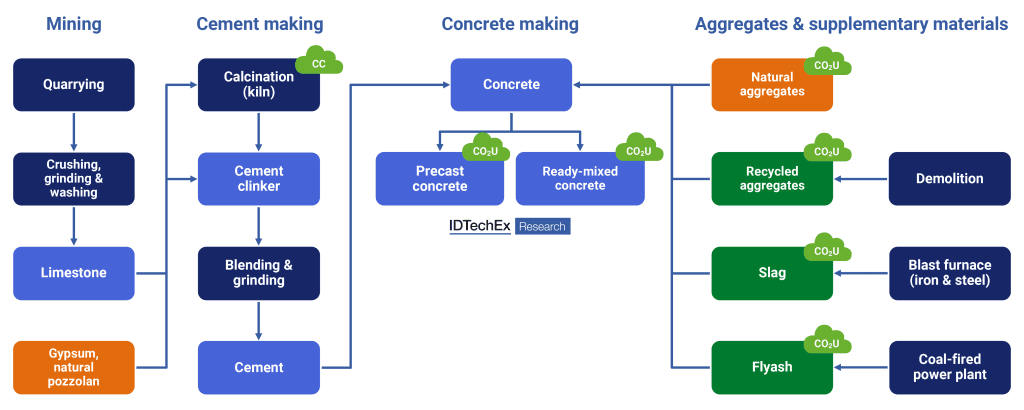

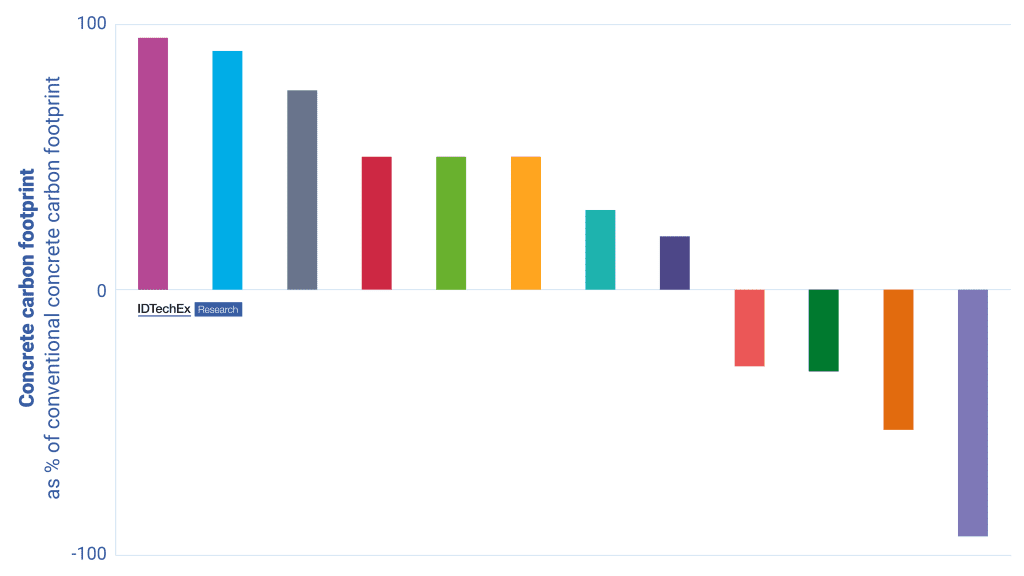

The new IDTechEx report “Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players” explores many ways to valorize captured carbon dioxide to create useful products. Among these, CO2-derived building materials showed particular promise due to performance improvements and cost-competitiveness, as well as sustainability benefits. IDTechEx forecasts over 170 million tonnes of captured CO2 will be utilized in building materials by 2044. Carbon dioxide can be utilized in concrete production in three different ways: injection of CO2 during curing of precast concrete, injection of CO2 during mixing of ready-mixed concrete, and formation of carbonate aggregates/additives

Unlike some other carbon dioxide utilization pathways, such as the conversion to e-fuels, which requires large amounts of energy and green hydrogen (often prohibitively expensive), the basic mineralization chemistry underpinning the uptake of CO2 during concrete manufacturing is thermodynamically favored and less energy-intensive because stable metal carbonates are formed. These carbonates represent effectively permanent sequestration of CO2, so CO2-derived building materials double up as simultaneous carbon dioxide utilization and carbon dioxide storage. The process is compatible with many different sources of CO2.

Valorizing waste

In addition to waste CO2, solid waste streams can also be repurposed into new concrete using CO2 mineralization chemistry to form carbonates. For example, CO2-derived concrete players include Swiss company neustark, who uses the reaction of CO2 with demolished concrete to store carbon dioxide and produce concrete aggregate. Another aggregate producer, UK-based O.C.O Technology, instead uses CO2 and waste materials from industrial thermal processes. Meanwhile, building materials giant Heidelberg Materials has ongoing R&D into recycling concrete using CO2 to form a cement substitute. Steel slag is being explored by companies including Carbonaide and CarbiCrete as a cement replacement during CO2-aided curing. Additional revenue can be generated through waste disposal fees, with some CO2-derived concrete players reporting to having already achieved price parity with incumbents.

Accelerating adoption

Concrete production is typically low-margin, and willingness to pay a green premium is low. Therefore, widespread deployment of CO2-derived concrete will rely on CO2 utilization technology players, creating easy-to-adopt solutions that are minimally disruptive to existing manufacturing processes. In CO2-aided curing, some players have targeted retrofittable curing chambers. Elsewhere, plug-and-play and mobile unit solutions are also being commercialized.

2023 saw the release of several ASTM standards around CO2-aided curing, improving confidence in the safety and quality of CO2-derived precast concrete. While many CO2-derived building materials have yet to achieve price parity with conventional concrete, some customers are willing to pay a premium due to enhanced performance (such as higher strength and improved aesthetics).

Going beyond net-zero

The direct uptake of CO2 into concrete can be a net-zero process if the carbon dioxide is sourced from a fossil point source (such as a coal power station) or a net-negative process if biogenic or direct air-captured CO2 is used. In 2023, a collaboration between direct air capture (DAC) company Heirloom and CO2-derived concrete player CarbonCure stored CO2 captured from the ambient air into concrete for the first time. But is CO2-derived concrete still net-negative when considering the CO2 released during cement production? The formation of metal carbonates during CO2 mineralization can increase concrete strength and reduce the amount of cement needed. Alternatively, some carbonate additives can act as supplementary cementitious materials and replace cement. Therefore, according to IDTechEx’s analysis of players, several can produce carbon-negative concrete products. The permanent storage of CO2 into concrete enables players to sell high-value carbon dioxide removal credits on the voluntary carbon market.

The way forward

Although the production of CO2-derived concrete is more expensive than conventional concrete, revenue can be generated through waste disposal fees and carbon credit sales, with some players already reporting to achieve price parity. In the future, stronger regulatory support (for example, increased carbon pricing) will accelerate uptake further, with IDTechEx forecasting over 170 million tonnes of captured CO2 will be utilized in building materials by 2044. With carbon capture solutions for cement kilns continuing to develop, CO2 could be sourced from cement production, creating a circular solution.

To find out more about the new IDTechEx report “Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players”, including downloadable sample pages, please visit www.IDTechEx.com/CO2U. For more information on IDTechEx’s CCUS (carbon capture, utilization, and storage) market research portfolio, please refer to the IDTechEx “Carbon Capture, Utilization, and Storage (CCUS) Markets 2023-2043” and “Carbon Dioxide Removal (CDR) Markets 2023-2040: Technologies, Players, and Forecasts” reports

Building, Design & Construction Magazine | The Choice of Industry Professionals