By BCO Media

London continues to outperform, sustainability and employee experience matter most and supply remains a critical issue.

London continues to outperform, sustainability and employee experience matter most and supply remains a critical issue.

Those were some of the key takeaways from the recent BCO NextGen London & South East Committee and Carter Jonas hosted Q2 Market Update webinar.

The session, which took place on 12 August, offered a detailed analysis of the Central London office market from the occupier’s perspective, focusing on demand dynamics, supply constraints, and future outlook.

The panel was hosted by Carter Jonas’s Lucy Atkins (BCO NextGen London & South East Committee member) and feature expert insights from research associate Sophie Davidson, head of research Daniel Francis, and head of tenant representation Michael Pain.

Francis presented a macroeconomic overview, noting that while UK growth remains subdued, London continued to outperform. He highlighted that London’s economic growth had historically averaged 2.5% annually, compared with 2% for the UK as a whole.

“London’s resilience is underpinned by strong infrastructure investment, population growth, and a robust office-based employment forecast,” said Francis. He projected 460,000 new office-based jobs in Greater London over the next decade, driven by professional services and tech sectors.

Pain said that while demand for office space was strong, occupiers were focused on three key drivers: sustainability, employee experience, and talent attraction.

Businesses are increasingly relocating to Grade A buildings with strong environmental credentials, he said, using high-quality office space to foster collaboration and support recruitment. Pain also noted the rise of landlord-funded fit-outs, which offer tenants turnkey solutions and reduce upfront capital expenditure.

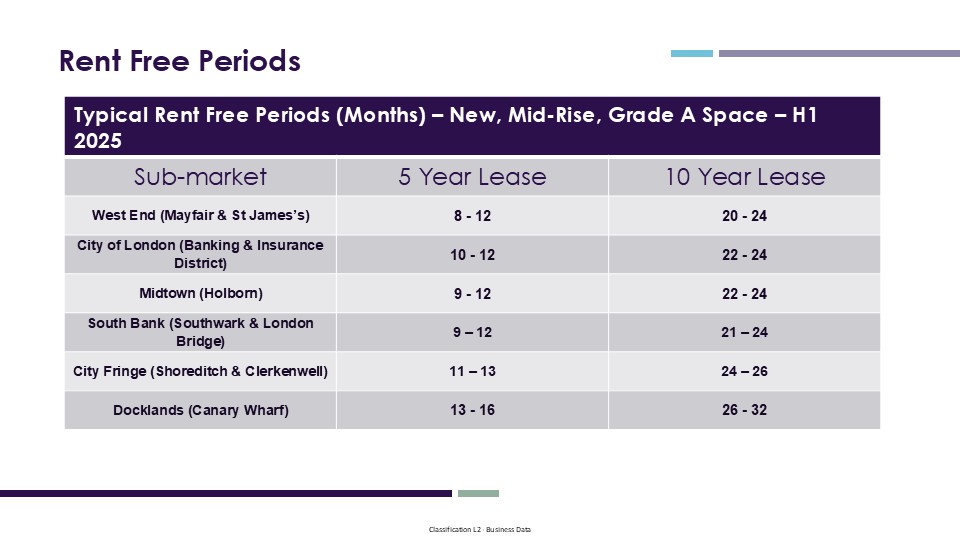

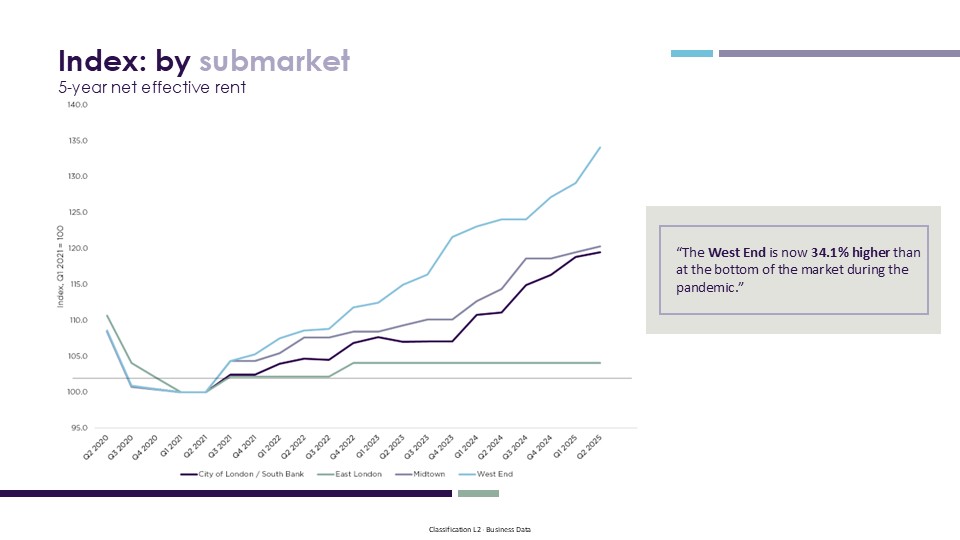

Supply, of course, remains a critical issue, said Carter Jonas. The market is experiencing a shortage of new and refurbished Grade A space, exacerbated by rising development costs, geopolitical uncertainty, and regulatory pressures. This imbalance has led to significant rental growth, particularly in the West End, where headline rents have reached £167.50 per sq ft, with some deals exceeding £215 per sq ft. Rent-free periods have remained stable, as landlords prioritise headline rents to support investment valuations.

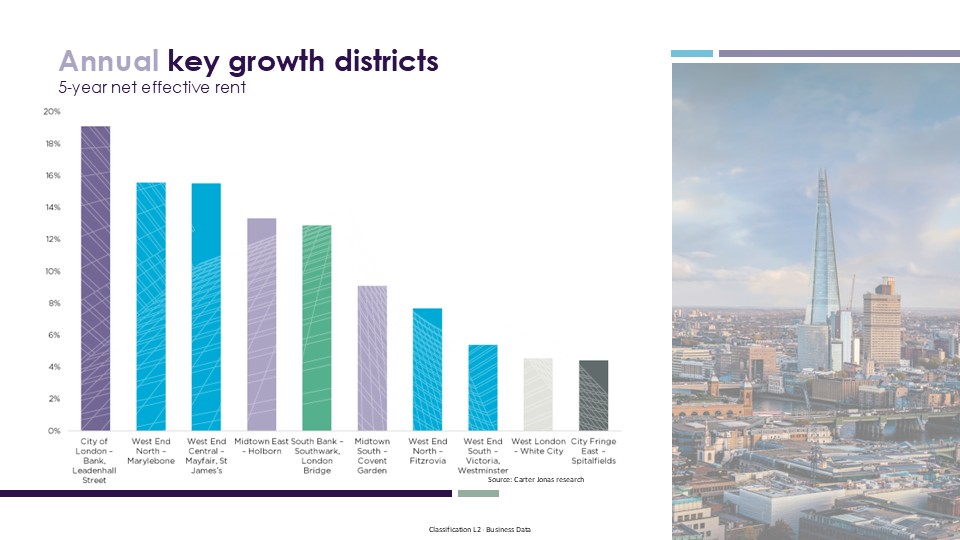

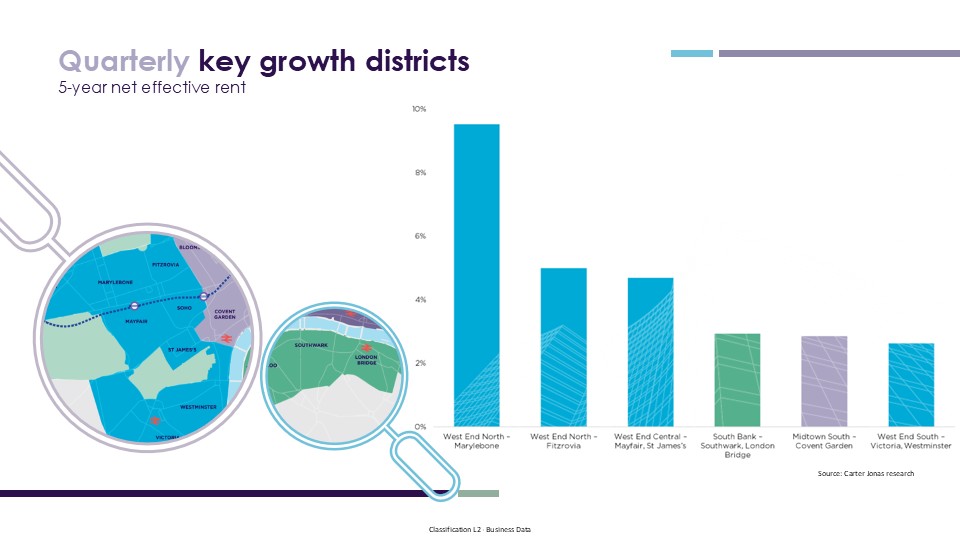

Davidson, said there had been a 6% rise in net effective rents across central London, led by the West End, which reported a 8.1% rise and the City, up by 7.5%. Net effective rents take into account rent free periods.

Districts such as Marylebone and Mayfair saw the strongest growth, driven by limited availability and pre-letting activity.

The panel also discussed the impact of upcoming EPC regulations and their influence on lease lengths and investment risk. Davidson noted that 80% of London’s office stock could become non-compliant by 2030, prompting tenants to secure long-term leases in sustainable buildings now.

What was clear from the data presented was London’s enduring appeal and adaptability for both occupiers and investors.

“London’s ability to consistently outperform the UK economy is not accidental,” concluded Francis, “It’s the result of strategic investment, global connectivity, and a dynamic workforce. That growth story is far from over.”

Building, Design & Construction Magazine | The Choice of Industry Professionals

News from the British Council for Offices news site.