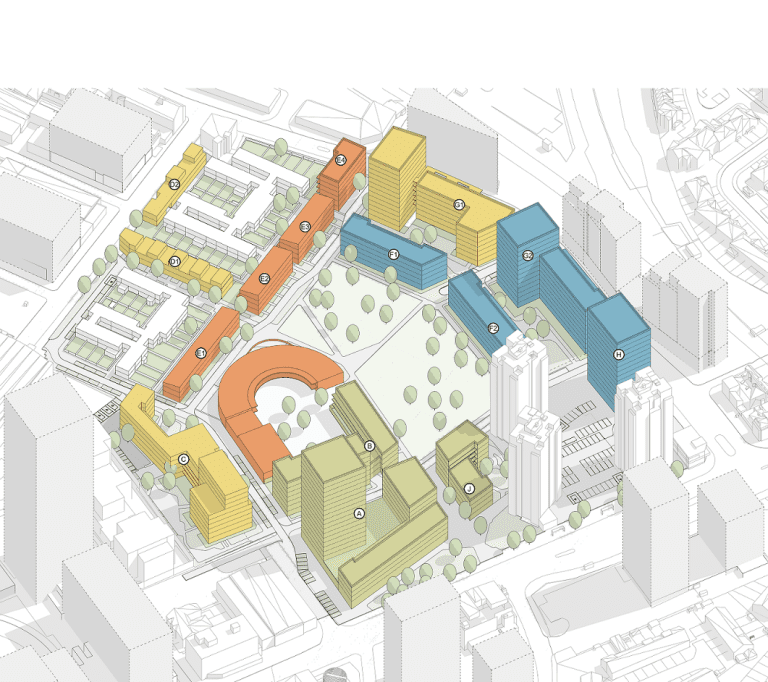

A SIGNIFICANT housing project has been announced as the first large-scale project procured through national framework provider Pagabo’s Developer Led Framework. Southwark Council has selected Linkcity as developer for its Tustin Estate scheme, which will feature nearly 700 new homes. This includes 200 replacement council homes, around 50 shared equity properties, around 220 additional council homes including keyworker homes, and around 220 homes for sale. A Pre-Construction Services Agreement is set to be signed to kick off the process. The project also includes a central park, several refurbishments of existing council homes and at least 1,800 sqm of commercial floorspace. Linkcity, part of the Bouygues Construction group, will work with the authority over the coming months with a view to signing a full development agreement in summer 2022 with Bouygues UK as the main contractor for the scheme. Construction will begin late 2022 and is planned to complete in summer 2028. Pagabo’s £47bn Developer Led Framework was the first framework of its kind when it launched to the market in December 2020, with 29 companies appointed across nine lots to deliver projects across a huge variety of development sectors. Jonathan Parker, head of construction at Pagabo, said: “I am thrilled to have been involved with the procurement of a developer for the Tustin Estate low rise redevelopment programme, which will provide much needed improvement and expansion of Southwark Council’s existing social housing provision, as well as upgrading the facilities for people in the area. “The Developer Led Framework was launched as a unique market offering to help procure significant projects that make a huge social difference, and Tustin Estate is exactly that. Having been heavily involved from the outset, we’re really excited to see this project come to fruition over the coming years.” As part of the framework and procurement process, Pagabo assisted with the procurement advice, development’s business case, early engagement, expression of interest, formulating the invitation to tender, quality scoring and tender moderation, tender summary report, and notification letters. Cllr Stephanie Cryan, Cabinet Member for Council Homes and Homelessness, said: “We are delighted to welcome Linkcity to the Tustin Estate and look forward to working with them and our residents to build quality new council homes. Southwark has one of the most ambitious council house building programmes in the country and the work on Tustin Estate will not only help us reach our aim of providing new housing but also enhance the estate for current residents.” As part of the initial phase of development, Linkcity will create around 200 new homes to rehouse current tenants of the estate. In addition, the developer will deliver 440 homes across two further phases over the next three years, through its construction partner Bouygues UK, with at least half of these designated as affordable housing. Tom Jackson, development director at Linkcity said, “We’re delighted to be working in partnership with Southwark Council and the Tustin Estate residents to deliver the first project on Pagabo’s Developer Led Framework. It’s a great opportunity to provide social and economic value through local employment and education opportunities, as well as new homes for this thriving community.” For more information about Pagabo please visit https://www.pagabo.co.uk/.